Pursuing higher education is expensive, and many students find themselves in debt due to having to take out student loans to finance their education. Managing student loans can be overwhelming and complicated, and many students are uncertain of how best to manage their borrowing. This article provides a roadmap to help students create a plan for managing their student loans and becoming debt-free.

By understanding the different loan options and developing strategies for budgeting and repayment, students can plan for their education and create a pathway toward becoming debt-free. Through careful planning, students can confidently manage their student loans and get the most out of their education.

Understanding Student Loans and Repayment Options

Student loans are an important part of financing higher education. They come with many forms and repayment options, so it is essential for students and parents to understand the way they work in order to maximize the benefit of student loan borrowing.

When considering student loan options, consider a few key questions and points before making any decisions:

- How much can you borrow?

- What are the interest rates?

- Are there fees associated with the loan?

- What repayment options are available with the loan?

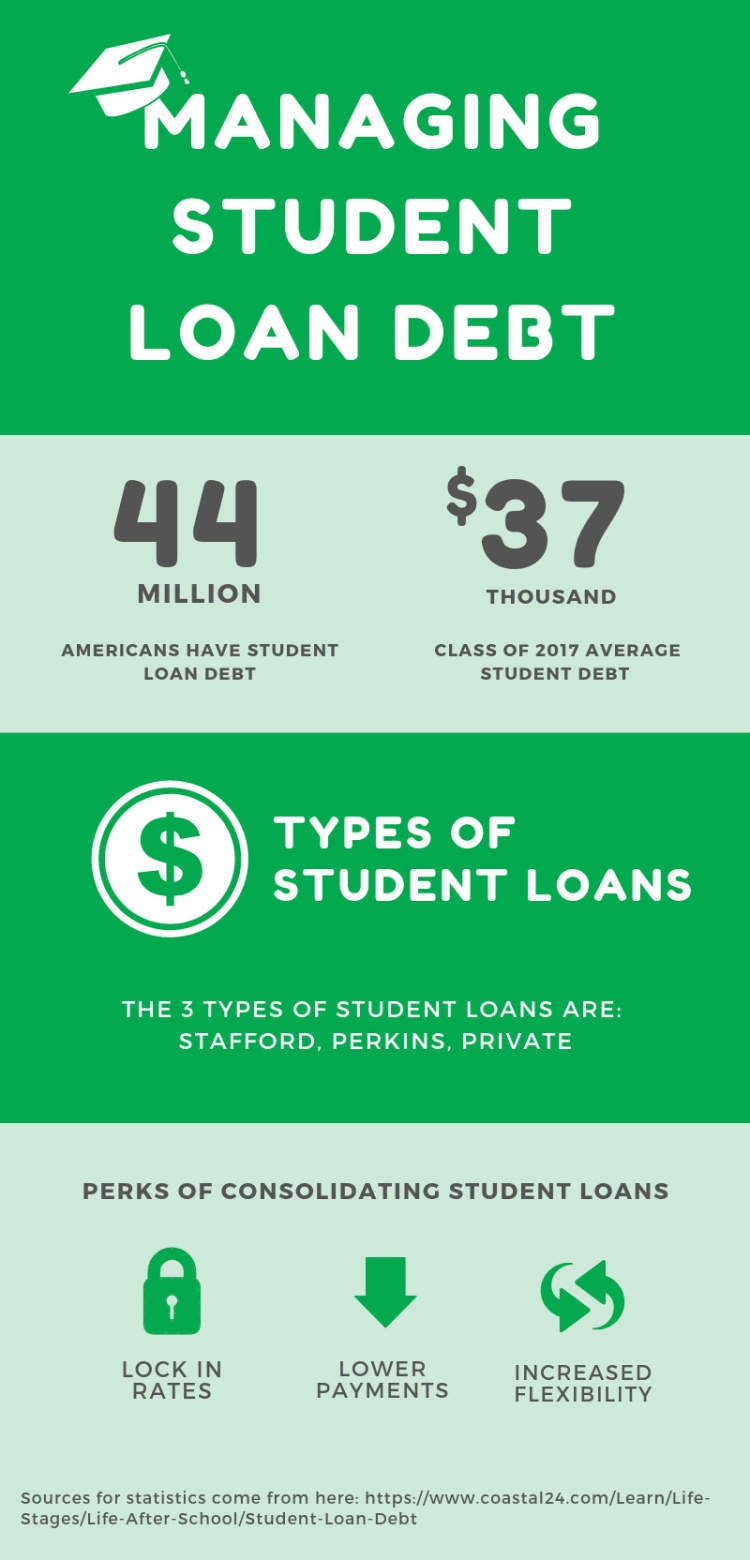

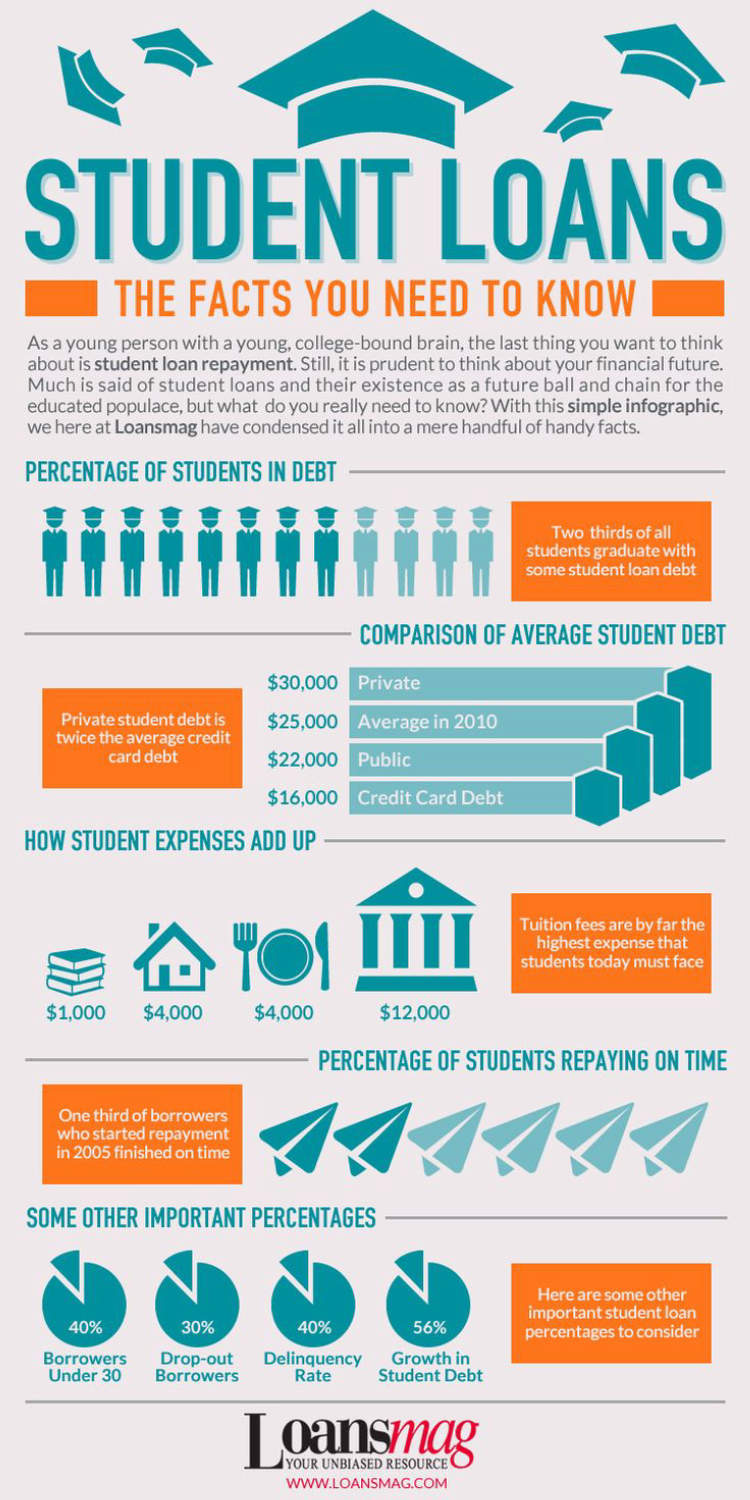

It is important to note that there are two types of student loans: federal student loans and private student loans. Federal student loans are offered by the government and are very beneficial to those who want to attend college or pursue higher education. These loans offer low interest rates and flexible repayment terms, with repayment periods typically lasting ten years.

Private student loans, on the other hand, are provided by banks and other lenders. These loans have a higher interest rate than federal student loans and have less flexible repayment terms, making them riskier for students. Additionally, private student loans can have origination fees and other charges that are not offered with federal student loans.

In terms of repayment options, there are several options available, and it is important to understand the differences between them. Standard repayment plans are the most common way of repaying student loans, with the monthly payment amount and length of repayment determined by the loan and repayment plan chosen.

Income-driven repayment plans are designed for borrowers who are struggling to make their monthly loan payments. With this type of plan, borrowers can adjust their monthly payments based on their income, reducing their total loan debt over time.

Finally, deferment and forbearance are two other options available to borrowers who are unable to make their loan payments. With these plans, borrowers can temporarily stop or reduce their loan payments for a short period of time.

Building a Repayment Plan and Sticking to It

Having a solid plan for repaying student loans is essential when managing debt. After graduating, many students have to begin repaying these loans soon. To help manage student debt, it’s a good idea to create a repayment plan. It’s important to take into account income, expenses, and a timeline when making a plan. Here are some tips for building a sound repayment plan and sticking to it:

Evaluate Loan Options

Before settling on a loan, students should research their options carefully and shop around. Evaluating interest rates, repayment terms, and other agreements will help make sure that students choose the loan most suited to their needs and financial situation.

Create A Budget

Budgeting is an important part of managing student debt. Creating an accurate budget can help students decide how much they can afford to pay each month on loans. Start by calculating total income and total expenses. From there, set a budget that accounts for loan payments, rent, other living expenses, and saving money to avoid getting behind.

Make A Payment Schedule

Once a budget is set, it’s important to stick to it. Making a payment schedule can help keep track of loan payments and other financial obligations. A payment schedule should include a timeline, debts, deadlines, and the total amounts owed. It’s also important to keep track of payments and savings.

Consider Consolidation and Refinancing

If students have multiple loans, consolidation and refinancing could be a good option. Consolidated loans often feature lower interest rates and longer repayment terms. Refinancing means replacing a loan with one that features a lower interest rate, so students can save money in the long run. It’s important to weigh the pros and cons before opting for either of these options.

Set Up Automatic Payments

Setting up automatic payments can help enforce the repayment plan. Regular payments can help prevent missed payments and fluctuations in interest rates. Automating payments also helps build a good credit rating.

Make Extra Payments When Possible

If students find they have extra money, making extra payments on their loans can be a great way to pay them off faster. Even small extra payments can make a difference in the long run.

Rely on Support

Finally, relying on family or friends for financial support can be a great way to manage student debt. In some cases, family and friends can offer help in paying off debts. Reaching out to those who can offer financial and emotional support can be a great way to stay on top of payments and keep up with the repayment plan.

Building a sound repayment plan and sticking to it is the best way to manage student debt. Taking the time to evaluate loan options, create a budget, and consider consolidation and refinancing can pay off. Setting up automatic payments and making extra payments if possible can help keep payments on track. Relying on support, financial and emotional, can also be a great way to come up with a solid repayment plan and manage student loans.

Exploring Strategies to Simplify Repayment

For many students, dealing with student loan debt can feel like a heavy burden. There are several repayment strategies available to help make repayment easier and more manageable. To take control of student loan payments and increase the chances of becoming debt free, here are several strategies to explore:

1. Income-driven repayment plan

Taking on an income-driven repayment plan is the simplest way to simplify repayment for student loans. This plan works by adjusting the loan payments based on the borrower’s income level. The repayment period can also be extended for up to 20 years, meaning the loan payments will become more affordable. Additionally, borrowers may also qualify for loan forgiveness after a specific period of time.

2. Consolidation

Consolidating student loans can help simplify payments. It is the process of combining several student loans into one loan with a single lender. Unlike income-driven repayment plans, consolidation does not decrease the payment amount right away. But, it can help lower the overall costs, reduce monthly payments, and simplify the payment process by combining different student loan payments into one.

3. Investing in Refinancing

Refinancing is also another option to make repayment easier. Refinancing student loans is similar to consolidation; however, instead of combining multiple loans into one, it is replacing the existing loans with a new loan. By refinancing, borrowers can access lower interest rates, adjust the term lengths, or switch between a fixed and variable rate.

These strategies are meant to provide relief for those struggling to repay student loan debt. They can help simplify repayment and put borrowers on the path to becoming debt-free. However, because refinancing and consolidating can be a major financial decision, it is important to weigh the pros and cons before taking any action.

Conclusion

Managing student loans is an important but often overlooked form of financial literacy. Taking responsibility for your own debt and creating a plan to pay it off can be a daunting task, but taking those steps now could make financial freedom a reality in the future. Armed with a budget, an understanding of loan terms, and knowledge of repayment and forgiveness programs, you can create a roadmap to debt-free education that’s tailored to your needs.

Not every student loan situation is the same, so it’s important to do your research and find the best repayment options. Whether you’re a current student or already graduated, taking some time to understand your student loans, and using the advice in this article, will help you stay on the path to success.