The very idea of budgeting sparks different, and not necessarily positive, reactions. For some, it may bring a sense of despair and dread of complicated calculations while for others it involves reliving a history of financial missteps. No matter how financially savvy – or challenged – you may be, budgeting is an essential part of achieving financial success.

This guide to tracking expenses and budgeting will give you an understanding of where your money is coming from and going to, so you can take steps towards making smarter financial decisions. This comprehensive guide will help you organize your budget with clear objectives, identify areas of improvement and meet your financial goals.

Understanding the Basics of Expenses and Budgets

Having a good understanding of expenses and budgeting is essential for financial success. Expenses can be both expected and unexpected, so it’s important to be prepared for different scenarios. A budget helps give structure to how those expenses are handled. By having a plan for your budget, you’ll be able to manage your money better and avoid unnecessary spending.

When it comes to managing your finances, it’s important to understand the basics of expenses and budgeting. This could include a variety of topics such as:

- Defining and tracking expenses

- Creating a budget

- Analyzing your spending

- Saving money

- Setting financial goals

By understanding these basics, you can create a plan to manage your expenses and ensure your budget is optimized for financial success.

How to Track Your Expenses and Budget

Living within a budget is the key to financial success. Keeping track of your expenses and budgeting can help you stay on top of your finances and achieve your financial goals. To help you get started, here is an essential guide to tracking your expenses and budgeting for financial success.

Step 1: Get Organized

The first step to effective budgeting is to get organized. Consolidate all your financial records into one place and make sure to categorize each one. You can also try using a financial app to help manage your budget and expenses.

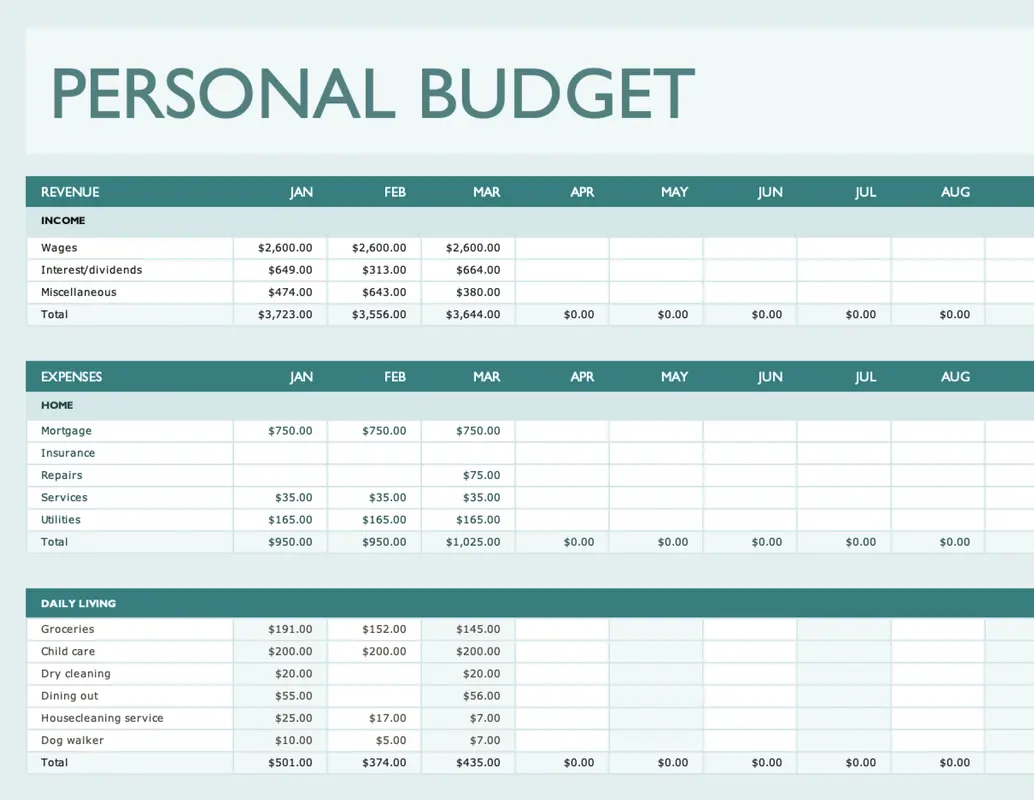

Step 2: Determine Monthly Expenses

The next step is to determine your monthly expenses. Start by making a list of all your essential expenses, such as rent/mortgage, utilities, and food. Then, add non-essential expenses like entertainment, clothes, and extras. Finally, add finances that vary from month-to-month like books, gifts, car registration fees, etc.

Step 3: Track Your Spending

Once you have determined your expenses, start tracking your spending. Knowing exactly where your money is going can help you stay on top of your finances and make better financial decisions. You can use mobile apps or write it down in a notebook. Whatever system you decide to use, make sure you document every expense.

Step 4: Create a Budget

Now that you know how much you are spending each month, it’s time to create a budget. Start by creating a list of your income and expenses and then decide which expenses are essential and which can be cut down. Finally, create a budget that meets your financial needs and goals.

Step 5: Monitor & Adjust

The key to staying within your budget is to regularly monitor and adjust it. You should review your budget every month to make sure you are on track and adjust it as needed. You should also review your financial goals and adjust your budget to reflect your goals.

Additional Tips

- Automate your finances where possible to streamline the process.

- Set up alerts and reminders to help you stay on track.

- Break down your monthly payments into weekly or bi-weekly payments.

- Track your progress and reassess your budget every few months.

Strategies for Optimizing Your Budget

In order to achieve financial success, it is important to accurately track and optimize your budget. Many people struggle to keep up with their finances and may need to enact strategies that will help them have a better grasp on their money. In this guide, we will provide essential strategies for budget optimization which can be implemented for financial success.

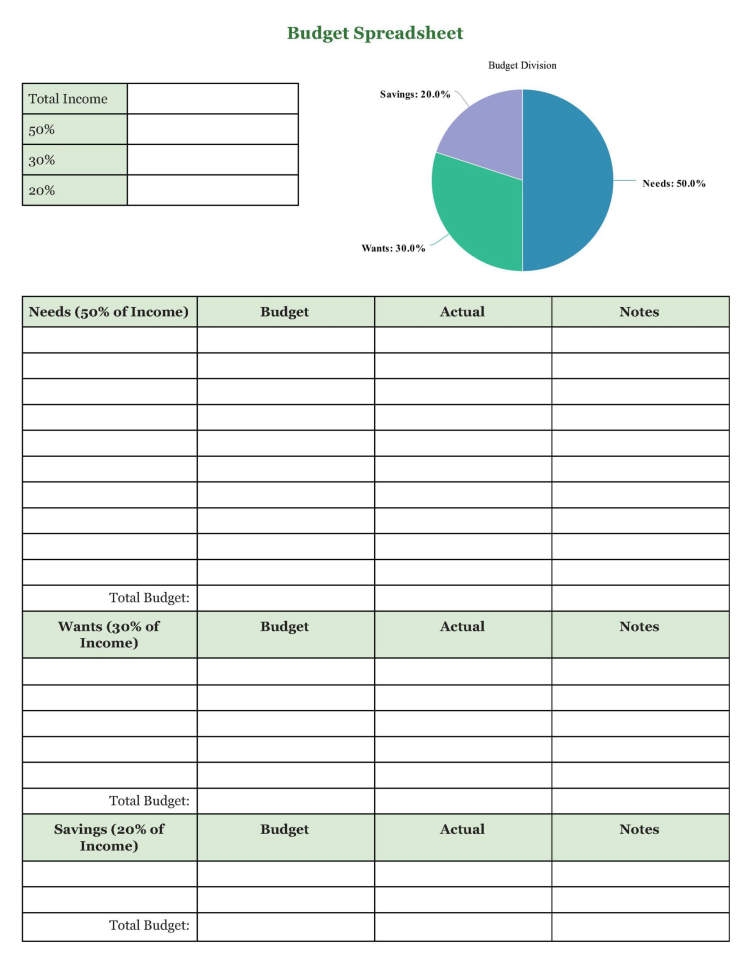

Develop a Strategy

Creating a budget optimization strategy can help you become more mindful of your expenses and manage your funds with clarity. You should establish both long-term and short-term goals and sort expenses into categories such as housing, entertainment, travel, and groceries. Visualize how you want to approach budget optimization and make sure to maintain realistic goals that are more achievable.

Track your Spending

It is essential to properly track your spending when you are optimizing for a budget. There are many tools and applications that can make it easier for you to figure out expenses and keep up with your fiscal progress. While tracking, ensure that you break down your expenses into categories such as bills, leisure, meals, etc. This will help you have a clearer understanding of where your money is going.

Create an Emergency Fund

You should not forget to store money away for any unexpected expenditures. Unexpected costs can occur at any moment such as car repair expenses or medical fees, and you should be prepared to handle such expenses. You should create an emergency fund and save a particular percentage of your income for any of these costs. This can help you remain financially organized.

Make Use of Credit Cards as Needed

Using credit cards can often provide you with immense savings and can make budget optimization easier. Look out for credit card benefits that you may be eligible for, such as rewards points for purchases. Use credit responsibly to acquire bills and payments, and make sure to pay them back in a timely manner. If you cannot keep your payments up to date, it can cause your credit score to drop.

Cut Costs Where Possible

You should make an effort to cut costs wherever you can. Here are some useful tips for cost-cutting:

- Take Advantage of promo codes and discounts

- Go on money-saving diets. For example, challenge yourself to spend less money on food or entertainment.

- Make use of public transport or other cost-effective modes of transportation.

- Perform regular itemized reviews and assess where you can cut costs.

- Eliminate fixed costs such as subscription services and gym memberships.

- Search for cheaper alternatives for goods and services.

Conclusion

Tracking expenses and being mindful about money spending can be difficult, especially when it comes to sudden urges and bills. However, by creating a budget then sticking to it, and knowing the difference between wants and needs, people can easily manage their finances and budget strategically. Building and maintaining financial security is an essential part of leading a fruitful and happy life.

The Essential Guide to Tracking Expenses and Optimizing Budgets for Financial Success provides individuals and families with a comprehensive understanding of how to better control their financial decisions. This guide is essential for achieving financial goals in the long-term as it includes best practices, tips, and information about budgeting.