Having the financial freedom to do the things you want, when you want is the ultimate goal for many Americans. This ultimate goal requires a careful balance of saving and spending, and an awareness of how to maximize your savings growth. One of the most efficient ways to grow your money is to take advantage of high-yield savings accounts.

High-yield savings accounts offer a great rate of return compared to other types of savings accounts. This means that your money will grow more quickly and you’ll have more funds available when you need them. It’s important to research the different high-yield savings accounts available so that you can find the one that offers the best features for your particular needs. This article will explore the benefits of high-yield savings accounts and how to maximize your savings growth.

The Benefits of High-Yield Savings Accounts

High-yield savings accounts offer various advantages compared to standard savings accounts. While the features of these accounts vary from bank to bank, they generally offer higher interest rates than traditional savings accounts, making them an ideal choice for saving and investing.

The following are some of the key benefits of high-yield savings accounts:

- Higher Interest Rates: One of the main benefits of high-yield savings accounts is their high interest rates. These rates are typically significantly higher than what you would get with a traditional savings account, so it’s a great way to earn more money on your savings.

- Flexible Investment Options: Unlike traditional accounts, high-yield savings accounts often offer a variety of different investment options. This means that you can diversify your investments and get the best return on your money.

- No Monthly Fees: Most high-yield savings accounts do not require any monthly fees. This is great news for those who are budget conscious, as it can help to reduce the amount of money you have to spend on banking fees.

- Low Minimum Balance Requirements: Many high-yield savings accounts also have relatively low minimum balance requirements. This makes them a great option for those who are just starting out with saving and investing or those who don’t have a lot of money to invest.

- Safety of Funds: Like traditional savings accounts, high-yield savings accounts are also FDIC insured, so you don’t have to worry about the safety of your money.

High-yield savings accounts offer a great way to save and invest money, and the variety of features and benefits make them an ideal choice for those looking to maximize their savings growth. With higher interest rates and flexible investment options, high-yield savings accounts can help you reach your financial goals much faster.

Understanding Interest Rates and Associated Risks of High-Yield Savings Accounts

High-yield savings accounts offer higher yields than traditional savings accounts, which means you can earn more interest on your deposits. However, accompanying these higher yields also come greater associated risks. It’s important to understand the interest rate and related risks associated with a high-yield savings account so that you can maximize your savings growth while avoiding potential losses.

Understanding Interest Rates

The primary benefit of high-yield savings accounts is the higher interest rates that they offer. The rate of interest that you receive is largely determined by the amount of money that you invest, with larger investments typically yielding higher rates of return. Additionally, the rate of interest may fluctuate over time, with rates going up or down depending on the state of the economy. It’s important to carefully consider the rate of interest offered by a high-yield savings account before investing in order to ensure that you’re receiving a competitive rate.

Risks of High-Yield Savings Accounts

It’s important to understand the associated risks of high-yield savings accounts before investing. The most common risks include:

- Market risk: High-yield savings accounts are subject to market fluctuations, which could cause your principal balance to be reduced.

- Liquidity risk: It may be difficult to withdraw your money from a high-yield savings account, which can limit your ability to access funds in an emergency.

- Currency risk: Investing in a foreign currency carries certain risks, including exchange rate fluctuations and instability in the currency market.

It is important to weigh all of these risks before investing in a high-yield savings account. Additionally, it’s important to research different high-yield savings accounts to compare rates and make sure that you’re getting the best possible rate of return on your investment.

Strategies to Maximize Your Savings Growth with High-Yield Savings Accounts

High-yield savings accounts offer a much higher rate of return with little to no risk, as compared to traditional savings accounts. With the right strategy in place, you can maximize your savings growth with a high-yield savings account. Here are some strategies to consider.

Choose a High-Yield Savings Account With the Best Interest Rate

When selecting a high-yield savings account, be sure to shop around and compare the interest rates of various banks. The higher the interest rate, the more your savings will grow over time. Browsing through online banking sites and researching different financial institutions is a great way to find the best rate for your savings.

Set Savings Goals and Stick to Them

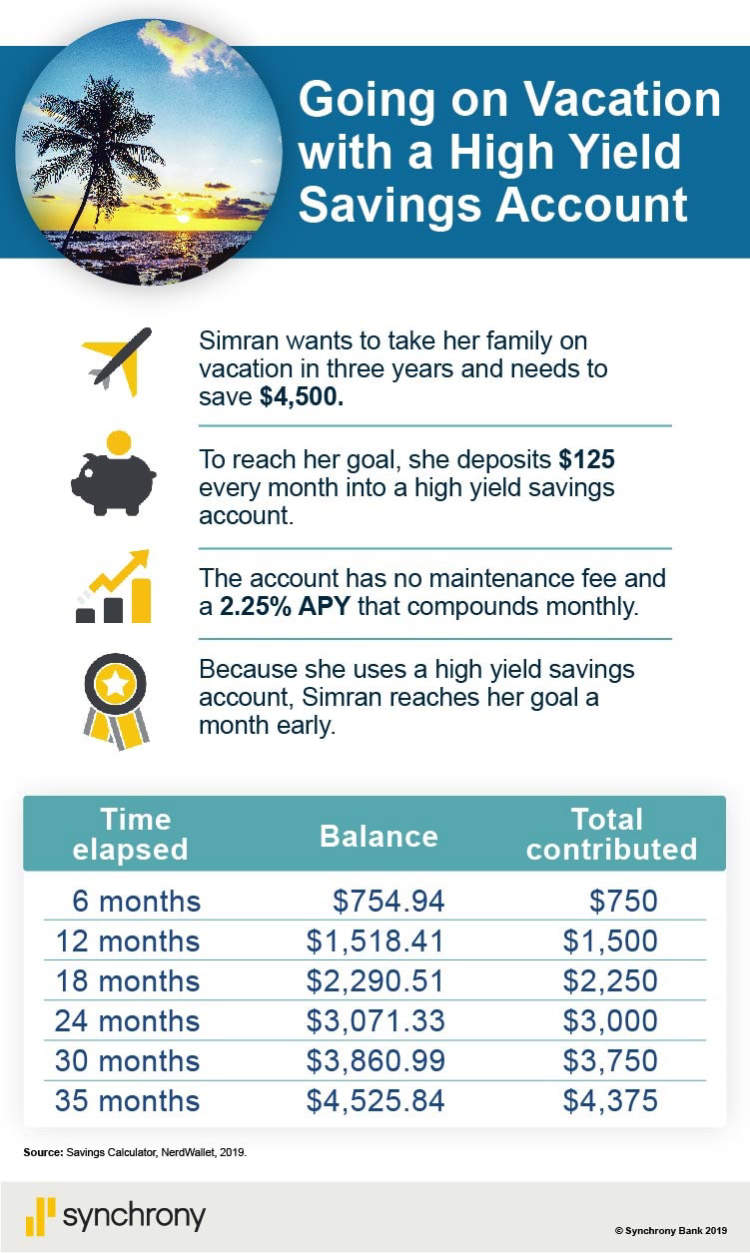

Before setting up a high-yield savings account, create a plan and set goals for what you want to accomplish. Determine how much money needs to be in the account at various times throughout the year or when you want to reach a certain amount of savings. Having goals will help keep you motivated and give you something to work toward.

Automate Savings Transfers

One of the best strategies for maximizing savings growth with a high-yield savings account is automating savings transfers. This can be done by setting up automatic transfers on a regular basis from your checking account into your high-yield savings account. This helps to ensure that you don’t forget to save each month and that your savings will continue to grow.

Take Advantage of Bonuses and Promotions

Many banks offer bonus and promotions for high-yield savings account customers. Take advantage of these by exploring the different offers and signing up for those that best suit your needs. You can get even more out of your savings with bonus interest rates, cash back rewards, and other benefits.

Conclusion

High-yield savings accounts provide a great way to increase your savings growth. By earning more interest on your deposits, you can potentially build up a larger savings account balance over time. Additionally, many of these accounts offer attractive features such as small minimum balances, no recurring fees, and zero insurance requirements.

Before signing up for a high-yield savings account, it is important to research the available options and compare them. Consider factors such as the interest rate, account fees, deposit limit, and customer service before making your decision. This will help you find the best high-yield savings account for your situation and help maximize your savings growth.