Financial security is a term becoming increasingly popular in today’s world; especially given the global spread of the coronavirus pandemic. Unexpected financial circumstances, such as job loss, can arise and create a situation of financial vulnerability. It is important to ensure that your future is secure and that you are financially prepared for unexpected events.

Safeguarding your financial future means taking steps to minimize risks in your financial life, preparing for unexpected events, and having a clear plan for how to manage your money. Financial security is a vital part of creating a sound economic future, and it’s important to become familiar with the basics of financial risk management and creating a budget.

What is Financial Security

Financial security is a state of affairs in which an individual has enough financial assets and resources to live without fear of economic hardship. It involves being able to manage and save money, having financial protection in case of illness, being able to pay off debts, and having funds to meet any unexpected need. Becoming financially secure is a long-term process rather than a one-off event.

Financial security ensures that you have the resources to fund your goals and dreams for the future. Whether you want to purchase a home, start a business or travel the world, practically anything is possible with the right amount of financial security. Having financial security can also provide peace of mind and give you the freedom to pursue the life you desire.

Here are some key elements to achieve financial security:

- Create and follow a budget.

- Put money aside for emergencies, retirement and other important goals.

- Track your net worth and make sure it is increasing over time.

- Invest properly to get a return on your money.

- Reduce debt and start building credit.

- Be aware of your insurance needs.

Achieving financial security may seem daunting at first, but with careful planning and dedication, it is possible to build your financial future. Start taking steps today to safeguard your financial future and become financially secure.

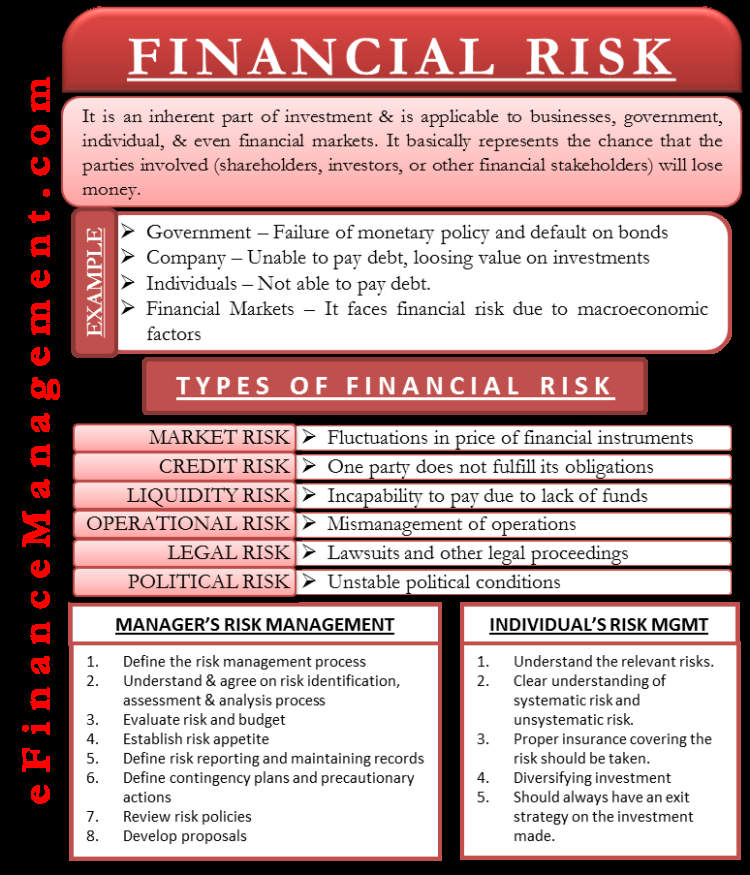

Identifying Potential Financial Risks

Understanding the risks that could affect your financial security is essential in safeguarding your financial future. Financial risks can come in many different forms, and it’s important to be aware of them so you can protect yourself and your assets. Some potential financial risks you should be aware of include:

- Market Fluctuations – Changes in stock market performance can cause your investments to decrease in value.

- Economic Downturn – Economic downturns can cause businesses and individuals to experience financial hardship.

- Natural Disasters – Hurricanes, earthquakes, and other natural disasters can disrupt businesses and cause financial losses.

- Credit Card Fraud – Credit and debit card fraud can cause you to suffer financial losses due to unauthorized charges.

- Data Breaches – A data breach can lead to the loss of sensitive information such as bank account numbers and credit card numbers.

- Identity Theft – Identity theft can lead to fraudulent charges being made on your accounts.

- Job Loss – If you lose your job, it can impact your ability to pay your bills and manage other financial obligations.

It’s important to take steps to protect yourself and your investments from these and other potential risks. Be sure to diversify your investments, use strong passwords, monitor your credit report, and take out adequate insurance.

Creating a Secure Financial Future

Creating a secure financial future is a major goal for many individuals. Everyone dreams of a comfortable retirement, but few take the necessary steps to ensure there will be enough savings and investments to sustain them. In today’s world, financial security is more important than ever. By taking certain key steps, you can develop a stable retirement plan, save more money, and invest wisely for the future.

Create a Budget

The best way to get the most out of your money is to create a budget. A budget will help you track your expenses and will help keep you accountable for your spending. Set up a budget plan that works for you and stick to it. This will help you keep your spending in check and meet your goals.

Save for Retirement

It is essential to start saving and investing for retirement as soon as possible. The earlier you start, the more you will be able to save and invest. Consider setting up an Individual Retirement Account (IRA) or making regular contributions to a 401(k) plan. If your employer offers matching contributions, take advantage of them.

Invest Wisely

In addition to saving for retirement, you should also invest wisely. Research various stocks and mutual funds to determine which ones will yield the best returns for you. Be sure to diversify your investments to reduce the risk of losing money. Also, keep up with current trends in the stock market and ensure that you are investing in companies with a long-term history of success.

Protect Your Assets

Another important step in safeguarding your financial future is to protect your assets. One way to do this is to purchase insurance, such as life insurance, health insurance, and home insurance. Make sure you understand the policies and what is covered before making a purchase. You should also consider setting up an emergency fund in case of unforeseen circumstances.

Stay on Track

The key to creating a secure financial future is to remain focused on your goals. Track your progress regularly and make adjustments as necessary. Set measurable goals and make sure you are staying on track to meet them. As you make progress, celebrate the small wins and remain focused on the bigger picture.

Seek Advice

Sometimes it is best to seek advice from a professional financial planner. A professional can help assess your financial situation and provide guidance on how to best achieve your financial goals. They can also help you choose the right investments and manage your money wisely.

Conclusion

Creating a secure financial future requires hard work and dedication. However, by following the steps outlined above, you can set yourself up for success. With careful planning and wise financial decisions, you can put yourself on the path to financial security.

Conclusion

Financial security is an essential factor in preparing for your future. It’s important that you take the time to understand your current financial situation, create a budget that works for you and implement strategies to manage your money more effectively. Additionally, investing in the right products for your needs and safeguarding your funds are all important elements to consider. Through proper planning and budgeting, you can be sure to protect your financial future and have access to the money you need during difficult moments.

In conclusion, financial security is important for a safe financial future. It’s important to create a budget, invest in suitable products and take measures to safeguard your funds. With smart financial management, you can ensure your financial well-being for years to come.