Money management is a fundamental life skill that is required for financial well-being. It involves tracking and monitoring spending, budgeting, and making smart long-term financial decisions. Despite its importance, money management and budgeting can be a daunting task to master.

This article will discuss various methods for effective money management and budgeting, as well as setting achievable financial goals in order to reach financial success. We will look at budgeting techniques, tracking expenses, financial goal-setting strategies, and common pitfalls to avoid when budgeting and managing money.

Understand Your Personal Finances

Understanding your personal finances is essential if you want to make the most of your money. To properly manage your finances, you must understand where your money is coming from and where it is going. Knowing this will help you plan and budget for both your short-term and long-term needs.

To get started understanding your personal finances, it’s important to gather all of your financial information in one place. This includes income documents, bank statements, credit statements, loans and mortgage information, and any investments you may have. You should review this information at least once per month to determine where your money is coming from and where it is going.

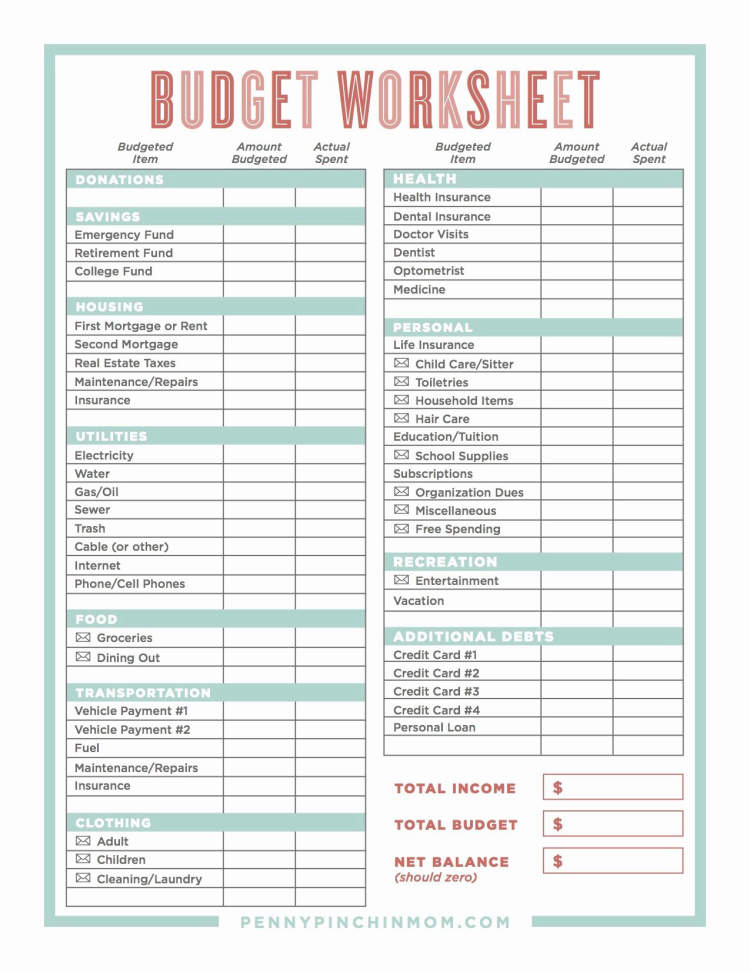

Once you have identified where your money is coming from and where it is going, the next step is to create a budget. This should include both your income sources and your spending. Consider any upcoming expenses that you might have, such as a vacation or a home renovation, and factor those into your budget as well. Also, make sure to set aside some money for emergency situations such as medical bills or a car repair.

It’s also important to look into investments, such as stocks or bonds. Investing your money can provide you with additional income and help you build wealth over time. However, it’s important to do your research and understand the risks associated with investing. Consider speaking with an experienced financial advisor who can guide you in making the right investment choices.

Finally, make sure to review your credit score and credit report periodically. This will help you understand your financial health and any areas where you may need to improve. You can get a free copy of your credit report each year from annualcreditreport.com.

By understanding your personal finances and managing them effectively, you can save money and make smart decisions with your money for both present and future needs. Mastering the art of effective money management and budgeting requires understanding your finances and making the most of your money.

Build a Budget That Works for You

Creating a budget is one of the most important steps you can take towards achieving financial success. A budget allows you to allocate your money in a way that ensures there is enough to cover your expenses and help you save for the future. The key to creating a budget that works for you is to start with a reasonable estimation of your income and expenses, and adjust it as needed. Here are some tips for creating a budget that works for you:

Estimate Your Monthly Income and Expenses

The first step to creating a budget is to estimate your monthly income and expenses. This includes items like your rent or mortgage payments, utilities, groceries, car payments, and other basic expenses. For each of these expenses, make sure to include an estimated amount and a description of the expense. You will also want to include any income you anticipate having, such as your salary or any part-time jobs you may have.

Set Financial Goals

Setting financial goals is an important part of the budgeting process. These goals can range from saving a certain amount of money each month to investing in stocks or real estate. Once you’ve set these goals, you can work back from them to determine how much you need to allocate to each expense and income source in order to achieve your goals.

Track Your Spending

Once you have established your budget, it is important to track your spending to make sure you are staying within your budget. You can do this by keeping receipts and tracking your expenses online or through an app. Keeping track of your spending will help ensure you are staying on budget and are making progress towards your financial goals.

Adjust Your Budget as Needed

As your financial situation changes, you may need to adjust your budget accordingly. This could mean reducing spending and making more room in your budget to save for the future. It could also mean increasing spending in order to pursue investment opportunities. Either way, it’s important to review your budget every couple of months to make sure you are still on track.

Creating a budget that works for you can be a daunting task, but it doesn’t have to be. By following the tips above, you can set yourself up for financial success and start mastering the art of effective money management and budgeting.

Get Smarter About Saving & Spending

Saving and spending is an integral part of everyday life. Achieving a true balance between these two activities can help you reach financial security and peace of mind. To gain a greater understanding of how to master the art of effective money management and budgeting, you’ll need to get smarter about saving and spending.

To start, a budget is one of the most effective tools to help manage your money. A budget can serve as a blueprint that helps you map out your expenses and savings goals. You should also evaluate your spending habits to identify areas where you’re overspending. Tracking your expenses and developing a plan that keeps you on track will help you stay within your means and make sure your budget stays in balance.

Next, consider your income and investments. Evaluate your current sources of income and potential investment opportunities to ensure you’re making the most of your financial situation. You can also explore options for maximizing the amount you’re saving, such as making direct deposits into savings accounts or setting up automatic transfers into investment accounts.

Finally, be mindful of debt. Evaluate your current debt, including any credit card balances or student loan payments. Consider strategies for repaying debt, such as making more than the minimum monthly payment or transferring your debt to a low-interest credit card. If you use credit cards, commit to paying off the balances each month to avoid building up higher interest payments.

By being smarter about saving and spending, you can gain greater control over your finances. Setting a budget, tracking your expenses, exploring investment opportunities, and reducing debt can help you master the art of effective money management and budgeting.

Conclusion

It’s important to understand that mastering the art of money management and budgeting can be a difficult process, but with hard work, dedication and determination it can be achieved. By controlling your spending patterns, setting realistic financial goals and finding creative ways to manage debt, you’ll be well on your way to becoming better at managing your finances. Honesty and transparency when setting up a budget is key; help yourself and your loved ones to better understand how to manage your finances.

The practice of budgeting and money management can be intimidating, but with proper education, planning and dedication, anyone can master these important life skills. Establishing successful money management habits have major long-term benefits, such as a stronger financial position in life and feeling more confident and in control of your financial situation.