Making the right stock market investments can be critical to managing your finances for a secure financial future. Accurately analyzing market trends is the key to getting the most from your investments. Understanding patterns of the past and predicting future movements are essential for creating a successful investment strategy.

In this article, we’ll discuss the steps necessary to analyze market trends for successful stock market investments. You’ll learn the importance of researching stock market history, assessing economic trends and knowing when to enter and exit the market. You’ll also discover other helpful strategies to maximize your profits.

Understanding Market Trends

Market trends help investors, traders, and business owners understand the movement of stock prices. In stock trading, market trends refer to the price movements of a security based on the cumulative total of all trades that have taken place in a given timeframe.{BACK24|R} Knowing how to analyze these market trends is essential for successful investment strategies. With an understanding of how the stock market behaves, you can make more informed and profitable decisions.

Here are some tips for understanding and analyzing market trends:

- Evaluate the current economic environment. Knowing how wider economic conditions will impact stocks is essential for investors. Evaluating political, economic, and market conditions will help you analyze how their changes will affect the stock market.

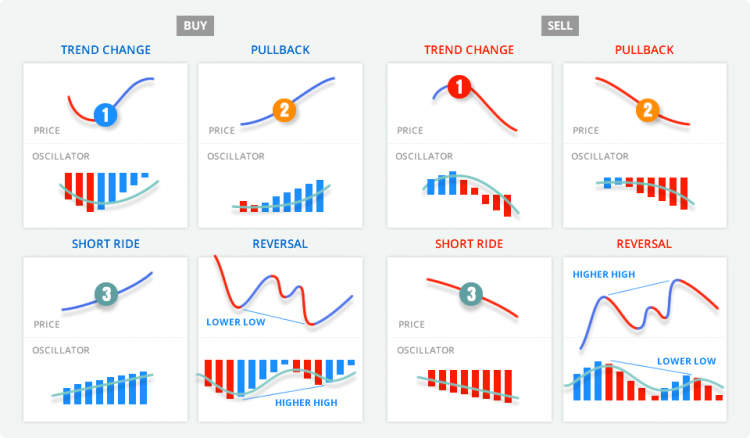

- Use technical analysis. Technical analysis involves studying past price action patterns, with the aim of making better predictions about the direction of future prices. This involves analyzing the trading charts, looking for crucial support and resistance levels, and identifying patterns that may indicate the direction of the stock price.

- Watch trading volume. As well as tracking how the stock price moves, it’s important to keep an eye on how active the trading is. If a stock has a low trading volume, it may suggest that traders are not confident in its prospects.

- Stay informed. New developments in industries and companies have a huge impact on the stock market. Investors should keep up with the latest news by reading financial publications and industry news, which will help them stay informed and make more profitable decisions.

By understanding market trends, investors can become better informed and make more profitable decisions. This is essential for any investor who wants to make successful stock market investments.

Making Predictions

Making predictions is an important tool when analyzing market trends for successful stock market investments. A prediction involves the analytical process of synthesizing data and making a reasonable, educated guess about the outcomes of a particular situation. Predictions may be made on anything from short-term market moves to long-term stock trends.

Accurately predicting market trends requires comprehensive research of relevant data and careful analysis of the data’s relevance, strengths, and biases. By analyzing the data in terms of market dynamics, technical analysis, economic factors, and sentiment analysis of news, investors can make more informed decisions and avoid making investments that they are likely to regret.

Investors should also take heed not to place too much reliance on predictions. Making predictions can be a useful tool but it is important to understand that market trends are subject to change. Predictions will not always be accurate and it is important to stay on top of new developments and reinvestments.

There are a number of tools available to investors to aid in making predictions. Technical indicators, such as Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) can help investors identify potential gains and losses in the market. Fundamental analysis of a company’s financials may also provide guidance on stock performance. Additionally, sentiment analysis of news may reveal potential opportunities in the market.

By using a combination of these tools when analyzing market trends for successful stock market investments, investors can evaluate current market conditions and make more informed decisions when making investments. With a little research and analytical skills, investors can identify potential investments and make predictions that can help them to achieve successful investments.

Value Investing Strategies

Value investing is the strategy of selecting stocks that are priced lower than their true worth. By investing in companies that are underpriced according to their fundamentals, you can generate above-average returns. Value investing is one of the most widely-used and successful strategies in the stock market and requires the investor to take a long-term approach. In this article, we will explore some of the strategies used by value investors and how they can be applied to successfully analyze market trends.

Identifying Potential Opportunities

The first step in any value investing strategy is to identify potential opportunities. To do this, investors typically start by analyzing stocks with low price-to-earnings (P/E) ratios, which indicate that the stock is trading at a lower price relative to its earnings. Investors can also look for signs of undervaluation such as low price-to-book ratios, high dividend yields, and high free cash flow yields. Additionally, investors should observe company performance and look for potential catalysts that may drive the stock price higher.

Evaluating Value Stocks

Once a potential opportunity is identified, the next step is to evaluate the potential stock. Investors should assess the company’s financial statements, management team, and overall competitive environment in order to determine whether it is a good value. Additionally, investors should assess the stock’s risk profile by considering factors such as the company’s quality of earnings, leverage, and pricing. By employing a rigorous analysis of the stock, investors can be more confident that the stock is a good value and is likely to generate returns.

Monitoring Market Trends

Finally, value investors must monitor market trends to identify emerging opportunities and to make sure their positions remain profitable. This means investors should regularly follow news and events that may affect a stock’s price. Additionally, investors should monitor key economic indicators like GDP growth, unemployment, and inflation to identify broader market trends. By closely following market trends, investors can identify buy and sell opportunities in order to ensure their investments are generating returns.

Value investing is a timeless and effective investing strategy that can be used to analyze market trends for successful stock market investments. By combining a thorough analysis of undervalued stocks with careful monitoring of market trends, investors can generate consistent returns in any market.

Conclusion

Market analysis is a critical tool when investing in the stock market. By looking at historical and current economic data, investors can make informed decisions about where and when to invest. In general, understanding the basics of supply and demand is a good starting point. Additionally, keeping up with breaking news and announcements from companies and governments can help investors stay on top of the latest happenings in the stock market.

Making successful stock market investments requires both knowledge and experience. It can be beneficial for investors to gain a complete understanding of the economy and the stock market before venturing into trading. Armed with the proper information and analysis, investors can use these market trends to their advantage and potentially increase their returns.