Running a small business certainly has its share of challenges, but one of the most critical to address is financial management. From understanding taxes to planning for the future, managing your business’s money is essential if you want to succeed.

In this article, we’ll explore the unique challenges small business owners face in terms of financial management and look at potential solutions for addressing them. In addition, we’ll review strategies for taking your business’s finances from struggling to thriving.

The Challenges of Financial Management for a Small Business

The financial management of a small business is no small task. While it’s an essential part of business operations, it can be a difficult process to master. As a small business owner, you must be aware of the multiple financial challenges that you face, as well as understand how to address them. Below are some of the common issues that small business owners must tackle when managing their finances.

Cash Flow Management

Accurately managing cash flow is key to the success of any small business. If you do not maintain a proper balance between incoming and outgoing funds, your company’s profitability can be impacted. Cash flow issues can come from having too much money tied up in long-term assets, insufficient amounts of cash on hand at any given time, or slow-paying customers. As a small business owner, you must anticipate potential cash flow issues and find solutions to prevent or contain them.

Tax Planning

Taxes are an unavoidable expense for any business. It’s important to anticipate the costs that come with paying taxes and plan for them. Failing to plan for taxes can leave your small business without enough funds to pay them in full when they are due. It’s also important to stay up to date with any changes in the tax code that may affect your business. Utilizing the advice of a knowledgeable accountant can help you stay on top of your taxes and devise the best possible strategies for managing them.

Accounting Procedures

Setting up and maintaining accurate accounting procedures is a must for any small business. Without proper accounting practices, it can be difficult for small business owners to understand their financial position at any given time. Having an effective procedure for tracking expenses, assets, income, and liabilities is essential for staying ahead of any potential problems. Proper accounting procedures help create an organized and consistent approach to financial management.

Risk Management

Risk management is another important factor that should be taken into account when managing a small business’s finances. Risk is everywhere, and as a small business owner, you must be aware of what types of risks can affect your company. To mitigate risk, it’s important to create an action plan to identify potential risks and determine how to best handle them. Additionally, investing in the right types of insurance can protect your small business if any risks become realities.

Creating a Financing Plan

Financing is vital for the success of any small business. While there are many options when it comes to financing, it’s important to find the right option for your business. Whether it’s a loan, an investment, or other type of financial support, it’s essential to create a financing plan that will provide the best possible outcome for your company. Researching all of the available financing options and understanding the terms and conditions of each can help to ensure that you make the best decision for your business.

Conclusion

Financial management for a small business can be a challenging task, but it is essential for the success of any organization. By understanding the common challenges that come with financial management and having the right strategies in place, small business owners can prevent costly mistakes and make sure their organizations are running as effectively as possible.

Strategies for Better Financial Management of a Small Business

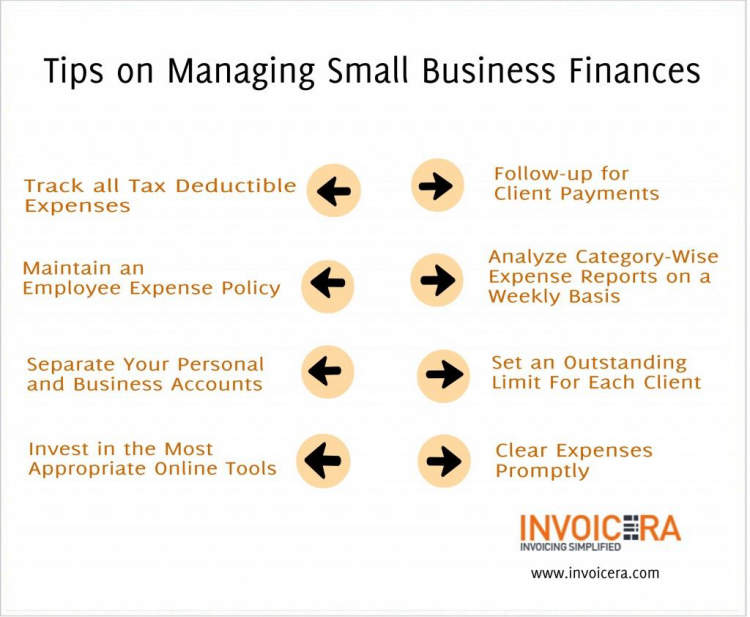

Managing the finances of a small business is a difficult task. It requires discipline, diligence and an understanding of financial concepts. To manage finances effectively, small businesses must develop and adhere to financial management strategies. Here are some tips for developing and implementing a successful financial management for small businesses.

Create a Budget and Stick to it

Creating a budget is the first step in any financial management plan. It helps businesses ensure that the money they receive is being spent and allocated where it is most needed. Businesses should take into account all possible expenses, including payroll, taxes, insurance, utilities, and any other applicable expenses. Once the budget has been created, it should be closely monitored and adhered to in order to help the business stay financially stable.

Have a Contingency Plan

No matter how carefully a business manages its finances, unexpected expenses or revenue shortfalls can arise. To help mitigate this risk, small businesses should develop a contingency plan. This plan should include steps such as reducing expenses, increasing revenue or securing alternative sources of financing. A contingency plan helps businesses keep their finances under control in times of need.

Automate Accounting and Collection

Automating the accounting and collection process can help small businesses save time and money. Automated accounting systems make it easier to track revenue and expenses, generate financial reports, and stay organized. Automating the collection process can also help businesses collect payments quicker and more accurately.

Monitor Performance Regularly

Small businesses should monitor their financial performance on a regular basis in order to stay on top of their finances. This includes keeping an eye on cash flow, tracking revenue and expenses, and paying attention to any changes in the marketplace. Regular financial performance monitoring helps businesses make informed decisions on how to best manage their finances.

Seek Professional Advice

Small businesses should never be afraid to seek professional advice when it comes to managing their finances. Consulting with a qualified accountant or financial advisor can help small businesses develop strategies to ensure their financial success. Additionally, seeking professional advice can also help businesses avoid costly mistakes.

By following these strategies, small businesses can manage their finances more effectively. Financial management is an important part of business success, and it is essential for small businesses to understand the challenges and develop the right strategies to ensure financial success.

Getting Help in Financial Management for a Small Business

Managing finances for small businesses can be a difficult and daunting task. Due to their limited resources and limited staff, most small businesses lack the expertise and knowledge in financial management. Without help, small business owners may find themselves overwhelmed by financial management tasks and unable to make sound business decisions. The good news is that there are resources available to help small business owners with their financial management needs.

To successfully manage a small business’s finances,it is best to get professional assistance from a finance expert. Experts in finance have the skills and knowledge to help small business owners understand financial statements, legal documents, and taxation issues. They can also provide advice on budgeting,cost-cutting solutions, and other financial tips. With their help, small business owners can develop realistic goals and financial plans to increase their chances of success.

The following are some useful resources to help small business owners with their financial management:

- Accounting software – Accounting software programs are an essential tool for small businesses, as they are designed to help manage daily transactions, track expenses and income, and stay organized. There are many different types of accounting software available, so small businesses should find one that suits their specific needs.

- Local banks – Local banks and credit unions are a great source of financial advice and assistance. Most banks offer small business banking services, such as loans and lines of credit, business-specific accounts, and financial advice. Having a good relationship with one’s local bank can make a big difference in the success of one’s small business.

- Financial advisors – Financial advisors are knowledgeable professionals who provide advice on investments, life insurance, retirement planning, and other money matters. They can be a great resource for small businesses, as they can provide an unbiased opinion on financial decisions and help create strategies to maximize profits.

- Professional organization – Professional organizations offer a wide range of resources and support for small business owners. Additionally, they may also host meetings, seminars, and workshops on various topics such as accounting, bookkeeping, taxes, and budgeting.

Getting help for financial management for a small business can be the difference between success and failure. With the right tools and resources, small business owners can increase their chances of success and become financially stable.

Conclusion

Financial management can be a daunting task for small business owners. With the right knowledge and tools, this challenge can be overcome and the business can achieve financial stability. Solutions to common financial management issues for small businesses include budgeting for business expenses, proper forecasting to maintain cash flow, using financial software to automate calculations and tracking, and maintaining accurate records of financial transactions.

Ultimately, the most important thing a small business owner can do is to understand the financial management that is required for their business. With the right planning and system, small businesses can be successful in managing their finances, enabling them to continue to grow and succeed.