Tax deductions can be powerful tools in allowing you to reduce the amount you have to pay in taxes each year. Strategic financial planning can allow you to maximize your deductions and take advantage of them in a way that can help minimize your tax obligation and increase your overall net income.

This article intends to provide you with a comprehensive guide of the different strategic financial planning techniques you can use to maximize your deductions throughout the year, by recognizing certain tax implications as soon as possible and taking full advantage of them.

What Are Tax Deductions?

Tax deductions are expenses incurred that are allowed to be subtracted from your taxable income. Deductions lower the amount of taxes you owe, which is why individuals and businesses alike strategize their finances to maximize these deductions.

Tax deductions vary depending on your filing status. Most deductions fall under either a standard deduction or an itemized deduction. Everyone can claim the standard deduction, while itemized deductions typically carry an income limit and must be claimed specifically rather than automatically.

The most common types of deductions are:

- Home Mortgage Interest

- Medical and Dental Expenses

- Property Tax

- Charitable Contributions

- Job Expenses and Certain Miscellaneous Deductions

Some deductions may also be available to those who are self-employed or running a business. Business deductions can include wages, insurance, interest, rent, and office expenses, among others.

No matter your situation, strategically planning to maximize your deductions can save you and your business thousands of dollars. Understanding what deductions are available to you and what your filing status is essential to growing and maintaining your finances.

Strategies for Maximizing Tax Deductions

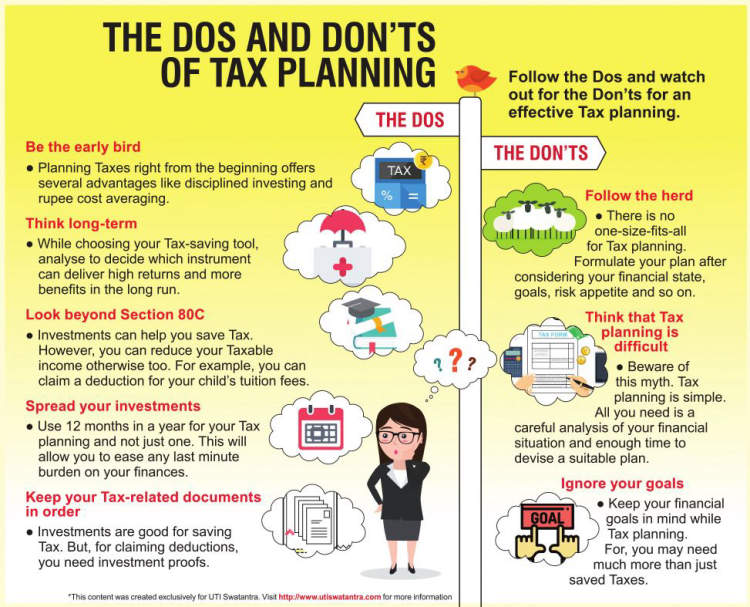

Tax deductions can make a significant difference in the amount you can save when filing your taxes each year. Strategic financial planning is an effective way to maximize these tax deductions and helps you keep more of your hard-earned dollars. Here are some strategies for optimizing your tax deductions.

Understand and Utilize Your Tax Deduction Options

The first step to optimizing your tax deductions is to know what you’re entitled to claim. Speak to a tax advisor or use tax software to make sure you’re aware of all of your tax deduction options and if you qualify for them. Some common deductions include mortgage interest, student loan interest, charitable contributions, property taxes, healthcare expenses, and more.

Keep Detailed Financial Records

You’ll need to keep detailed records of your financial and expense transactions throughout the year to maximize your deductions. Make sure you have accurate records of any business or investment expenses, as these can be used to offset your income and lower your tax bill. Additionally, keep your receipts and invoices for any tax-deductible items you purchase to back-up the deductions you claim on your return.

Maximizing Tax Breaks

There are certain tax breaks available that can be used to save money, either on an annual basis or even for the long-term. For example, you can contribute money to a retirement account, allowing you to save for the future without having to pay taxes on the money you invest. Additionally, there are tax credits available that can be used to reduce your overall tax liability.

Explore Insurance Deductions

Health insurance, life insurance, and long-term care insurance are all deductible expenses that can help reduce your tax bill. Additionally, self-employed taxpayers can write-off the premiums paid for insurance that is related to their business. Speak to a tax advisor to learn more about which insurance premiums you may be able to deduct.

Take Advantage of Special Tax Exemptions

Certain special tax exemptions may also be available, depending on your personal circumstances. If you’re a student, you may be able to take advantage of deductions related to tuition and fees. If you run a small business, you may be able to deduct business-related equipment and expenses. A tax advisor can review your situation and advise you on potential deductions and exemptions for which you qualify.

How to Implement Strategic Financial Planning to Maximize Deductions?

Maximizing tax deductions is an important step for any individual or business looking to limit their tax obligations. Strategic financial planning is essential to make sure the deductions you claim are valid and permissible. Here are some tips to help you implement strategic financial planning in order to maximize deductions.

Utilize Retirement Accounts

One of the most effective ways to reduce taxable income is by funneling money into retirement accounts, such as a 401(k) or IRA. These types of retirement vehicles not only provide tax deferral benefits, but also offer increased tax deductions in the short-term. Savings from a 401(k) plan are taken pre-tax, while contributions to an IRA are tax-deductible in the current tax year.

Organize Tax-Deductible Categorization

Start by tracking payments and recording expenses according to their tax-deductible categorization. Carefully sorting your transactions can help you identify potential deductions and maximize their value. On the other hand, it also helps minimize potential overspending, allowing taxpayers to make more effective use of their budget.

Gather Important Financial Documents

Compile and organize financial documents related to your deductions. This includes bank statements, charitable donation receipts, medical bills and other necessary documents. Having these documents on hand will make it easier to quickly substantiate and properly report the deductions on your tax returns.

Take Advantage of Tax Credits

Tax credits are an important part of any strategic financial planning process. Tax credits are more valuable than deductions as they are based on a taxpayer’s income and can reduce your taxable income dollar-for-dollar. Examples of tax credits include the Earned Income Tax Credit, the Child Tax Credit, the American Opportunity Credit and more.

Bookkeeping Preparedness and Consultation

With the continual changes in tax rules, it’s important to stay informed and up-to-date. Taxpayers should be aware of the different tax provisions and keep an eye out for new tax credits. Working with a trusted financial advisor or CPA can help taxpayers get organized, take advantage of tax deductions, and titrate the impact of taxes on their finances. Bookkeeping preparedness and consultation are valuable tools for those looking to maximize their deductions.

Conclusion

Tax deductions provide a great opportunity to maximize returns, both in the short and long term. Strategic financial planning is the key to maximizing your potential deductions, and should be integral to your overall financial plan.

Having a professional financial advisor in your corner is one of the best ways to ensure that you are taking full advantage of your deductions. Such an advisor can offer valuable guidance and insights into your financial situation, helping to ensure you are able to claim as much back as possible.