Tax planning and minimization can seem daunting for many taxpayers and business owners alike. With constantly shifting regulations and rules, applicable to different entities, tax planning and minimization can seem like an impossible task.

This comprehensive guide is intended to help taxpayers and small business owners understand the fundamental principles behind strategic tax planning and minimization, and how it can help save money and optimize resources.

Understanding the Basics of Tax Planning and Minimization

Tax planning and minimization are essential strategies for individuals and businesses to make sure that they can take full advantage of deductions and credits to minimize the amount of taxes due. It is important to understand the basics of tax planning and minimization in order to be able to make sound decisions about your taxes. By getting an understanding of how the tax laws work, you can make sure that you take full advantage of all the deductions and credits available to you.

Tax planning and minimization are based on an individual or business’s ability to effectively use the tax code to minimize taxes. This includes utilizing deductions, credits, and other strategies to reduce taxes due on a yearly basis. It also includes planning for retirement and for other life goals, so that the tax impact on these goals is minimized.

One of the most basic strategies of tax planning and minimization is to maximize deductions for items such as mortgage interest, charitable donations, and property taxes. By taking full advantage of deductions available through the tax code, individuals and businesses can save money and lower their taxable income.

Tax credits are also an important part of tax planning and minimization. Tax credits are available for things such as education, childcare, retirement contributions, home energy efficiency, and health care costs. These credits can help to reduce the amount of taxes due and can significantly reduce a taxpayer’s tax burden.

Finally, tax-deferred investments can help to minimize taxes. By investing in tax-deferred investments, such as 401(k)s and IRAs, taxpayers can defer taxes until the gains or losses from the investment are realized. This can help to reduce the amount of taxes due in the short-term and give the taxpayer more control over when and how their taxes are paid.

Understanding and strategically planning taxes is critical for any individual or business. By utilizing deductions, credits, and other strategies, taxpayers can reduce their taxes and take full advantage of all the benefits available to them. Whether you are an individual or a business, it is important to understand all of the basics of tax planning and minimization in order to make the most of your taxes.

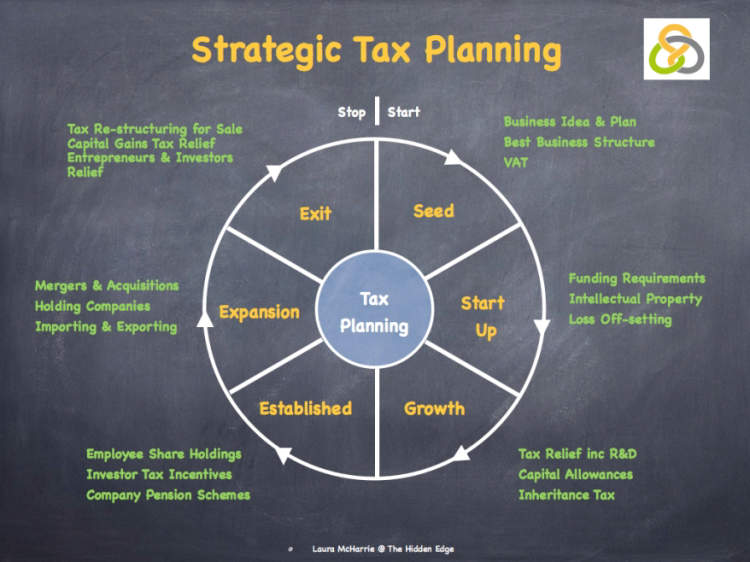

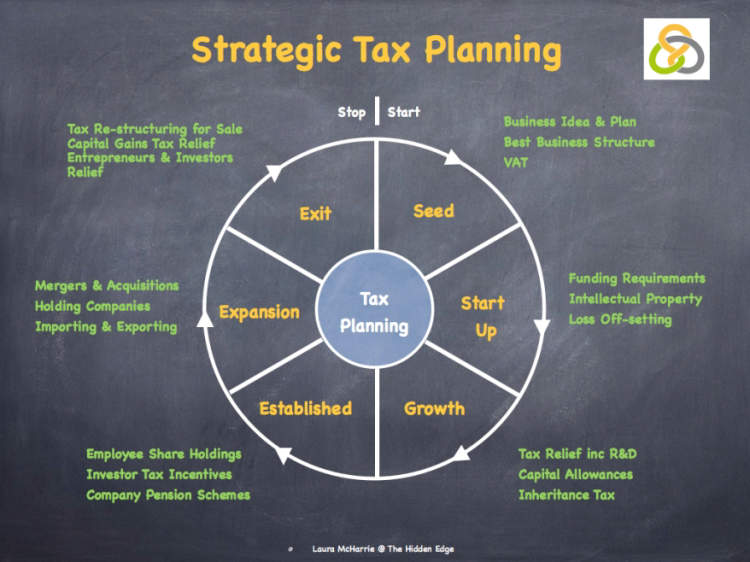

Approaches to Strategic Tax Planning and Minimization

Strategic tax planning and minimization can save businesses large amounts of money in taxes, yet so many companies overlook the potential benefits of proper planning. There are a wide array of approaches businesses can use to lower their tax burdens. This article will provide a comprehensive guide to strategic tax planning and minimization, so entrepreneurs and business owners can maximize their profits and reduce their operational costs.

In many cases, strategic tax planning and minimizing is simply about understanding the particular tax codes and regulations applicable to businesses in a particular country so that companies can take the steps required to reduce their tax burden. Companies may need to choose a specific ownership structure, a suitable method for accounting and reporting, and a financial plan that helps them properly align their finances with the existing taxation laws.

Without further ado, here are the approaches businesses should consider when planning and minimizing their taxes:

Reduce Your Taxable Income

One of the easiest ways to reduce your tax bill is to reduce your taxable income. You can do this by taking advantage of all available deductions such as donations to charities, business expenses, and educational expenses. Additionally, you can consider switching to a simpler and less costly accounting system so that you can reduce the costs related to the preparation of accounts and records.

Take Advantage of All Relevant Tax Credits and Deductions

Tax credits and deductions can be used to reduce a company’s overall tax burden. By taking advantage of the available reliefs, companies can significantly decrease the amount of taxes they must pay. Therefore, a successful tax planning strategy includes looking into all the available credits and deductions that the business may qualify for.

Optimize Your Investment Portfolio

Strategic tax planning also involves taking steps to optimize your investment portfolio. By doing this, businesses can minimize their tax liabilities by choosing investments with lower rates of taxation. Additionally, investments can be tailored to the specific requirements of the company, which can further reduce the amount of taxable income.

Develop an Efficient Tax Strategy

Developing an efficient tax strategy is another key part of strategic tax planning and minimizing. Businesses should plan out their tax strategies in order to make sure they are taking full advantage of the available credits and deductions and to make sure they are keeping their taxable income to a minimum. An effective tax strategy should be regularly updated and adjusted as the business’s needs change.

Seek Professional Advice

Businesses should always seek professional advice when it comes to strategic tax planning. It’s important to understand the intricacies of the tax laws and regulations applicable to businesses in your country, and a professional advisor can provide invaluable assistance and guidance. A qualified tax expert can also provide valuable suggestions on how companies can legally minimize their taxes and maximize their rewards from the different available strategies.

Tips for Effectively Utilizing Tax Planning and Minimization

Tax planning and minimization is an important part of a responsible financial plan. Properly managing and utilizing strategies, tools, and options makes a big difference in the amount of tax paid and in achieving financial goals. Below are some tips to get the most out of tax planning and minimization:

Understand Your Tax Situation

It’s essential to understand your tax situation before making any decisions, as this information is key when it comes to reducing tax liabilities. Fully understand current deductions, income levels, and information regarding your tax bracket. This will help you maximize your tax eligibilities and deductions when planning out strategies.

Maximize Deductions and Credits

Familiarize yourself with deductions and credits available to you and make sure to take advantage of all that you qualify for. Tax deductions, credits, and other strategies are available to those who take the time to understand and utilize them.

Stay Up To Date On Tax Laws

Tax law is constantly changing, and it is important to stay up to date to ensure you are taking full advantage. Check for any developments or updates of tax laws in your state and nationally, and make sure you are taking every advantage you can. Also, take note of any new laws that may affect you.

Utilize Tax Planners

Tax planners are a valuable resource, and you should consider utilizing their services to maximize your tax savings. Tax planning is enormously complex, and a qualified tax professional can be beneficial in recognizing and utilizing tax strategies available for your particular situation.

Consider Other Savings Strategies

Tax planning and minimization should be part of an overall financial strategy. Consider utilizing strategies such as tax-advantaged investing, retirement accounts, trust funds, and more. Research how these strategies work and what tax implications they have.

Plan Ahead

Proper tax planning and minimization require advanced planning. Start analyzing your options well before the end of the tax year to ensure you have taken full advantage of all available deductions and credits. This will help minimize any surprises down the road.

Make Use of Tax Software

Tax calculation can be complicated and tedious. Consider using tax software to streamline the tax prep process and maximize deductions. Tax software can be a great resource to help manage your taxes and can save you a lot time.

Conclusion

The ultimate goal of strategic tax planning and minimization is to reduce one’s tax bill and achieve financial goals in a legally compliant manner. Through careful and creative tax planning, individuals and businesses can identify and implement strategies that will help to alleviate the financial burden of an excessive tax bill. Additionally, individuals and businesses can use these strategies to ensure that profits or other forms of income are preserved, rather than minimized through taxation.

Ultimately, strategic tax planning and minimization involve understanding and assessing the individual or business’s tax situation, and then implementing strategies that are suitable for the planned purpose. By researching and consulting tax professionals as needed, individuals and businesses can ensure that their tax strategies are well-informed and compliant with local and federal laws.