Retirement is an inevitable part of life that everyone must prepare for, and there are various account options available to help grow your savings. Unveiling the potential of different retirement account options can be an overwhelming task, especially without the appropriate knowledge and advice.

This article seeks to educate people on the different types of retirement accounts, outlining the pros and cons of each option, and helping them work out which is most suitable for their needs. From 401Ks to Roth IRAs, this article will provide you with an in-depth look at various retirement accounts.

Introduction

Retirement planning has become an important priority for individuals nowadays. Combining the right benefits and contribution limits of various types of retirement accounts can provide individuals with a solid plan for retirement. With multiple retirement account options on the market, choosing the right one can be overwhelming. This article will provide you with the details of the different retirement account options, so that you can select the one that best suits your retirement needs.

This article will focus on the most popular retirement account types including:

- Traditional and Roth Individual Retirement Accounts (IRAs)

- 401(k)s, 403(b)s and other employer-sponsored retirement accounts

- Annuities

You will learn some basics about each retirement account option, including who can use them and what the major differences are between them. By the end of this article, you will have a better understanding of the various retirement account options and their advantages and drawbacks.

Overview of Retirement Account Options

Retirement is a big and important milestone in life. Choosing the right retirement plans and investments that are tailored to your specific goals can be a daunting task. There are several different types of retirement accounts, each with their own pros and cons.

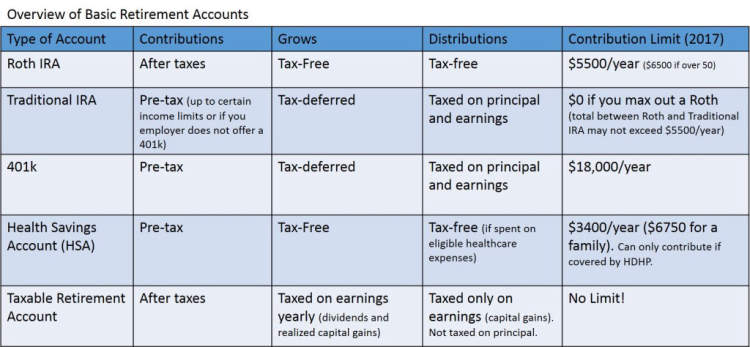

Individual Retirement Accounts (IRAs) are tax-favored accounts designed specifically for retirement savings. There are different types of IRAs such as Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs and more. Each IRA has its own eligibility requirements and contribution limits, so it’s important to choose the one that best fits your financial goals.

Employer-sponsored accounts such as 401(k) plans are also tax-favored retirement savings accounts. These plans typically include pre-tax contributions and post-tax contributions, as well as matching contributions from the employer. 401(k) plans also have different eligibility requirements depending on the employer.

For those looking to save for retirement but do not have access to an employer-sponsored retirement plan, Self-Employed Retirement Plans can be a great option. These plans are designed specifically for those who are self-employed and allow for higher contribution limits than IRAs.

Finally, there are annuities — a type of insurance product that functions as a retirement savings vehicle. Annuities have tax-deferred growth and provide guaranteed income payments when you reach retirement age.

Each of these retirement account options has its own benefits and drawbacks, depending on a person’s specific financial situation. It’s important to take the time to research and compare different retirement accounts to determine which one best fits your goals and objectives.

Benefits & Drawbacks of Each Retirement Account

Retirement accounts provide tax advantages for consumers and some employers provide matching contributions. Each type of retirement account has advantages and drawbacks that should be carefully considered before investing. Here are some of the potential benefits and drawbacks of the most common types of retirement accounts.

401(k) Retirement Accounts

401(k) accounts are employer-sponsored accounts, which means that the employer can choose to provide matching contributions to employee accounts. Employees can contribute pretax money, which can reduce their taxable income for the year. The money grows tax-deferred, meaning any gains are not subject to income tax until withdrawal. 401(k) accounts may include a wide variety of investments, which can make them more versatile than some other options.

- Benefits: Employer contributions, tax-deferred growth, wide range of investments.

- Drawbacks: High-income earners may be subject to tax penalties on contributions, limited withdrawal options and penalties for early withdrawal.

Roth IRAs

Roth individual retirement accounts, or IRAs, are individual retirement accounts. They are funded with post-tax income, meaning any contributions made will not lower the taxpayer’s taxable income. The money grows tax-deferred, however, and any income from investments is not taxed at withdrawal. The money can be withdrawn at any time without penalty.

- Benefits: Tax-deferred growth, no tax at withdrawal, no penalty for early withdrawal.

- Drawbacks: Limited contribution amount, income eligibility limits, no employer contributions.

Traditional IRAs

Traditional IRAs work similarly to 401(k)s in that contributions are made with pre-tax income and the money grows tax-deferred. Traditional IRAs can be great for high-income earners. While the income limits to be able to contribute to Roth IRAs may not apply, the contributions may still help to reduce the taxpayer’s taxable income.

- Benefits: Tax-deferred growth, potentially lower taxable income, wide range of investments.

- Drawbacks: Penalty for early withdrawal, high-income earners may begin to pay higher rates when making contributions.

There are a variety of retirement accounts available to consumers. When considering which type of retirement account is best for you, it is important to weigh the pros and cons carefully. All of the different types of accounts can be used to grow your retirement savings and provide a comfortable retirement.

Conclusion

Retirement accounts can be a great way to ensure a healthy future. By exploring the different account options available and investing wisely, you can build a secure financial cushion over time. With careful and proactive planning, you can increase your potential for a comfortable retirement.

It is important to take the time to consider all the retirement account options out there and to research any potential risks or benefits associated with each. Having the right financial strategy in place can reduce stress in retirement and provide peace of mind for the future.