When it comes to managing wealth, high-net-worth individuals have unique needs that require a specialized investment strategy. Creating tailored wealth management solutions for high-net-worth individuals can be a daunting task for those who don’t have the expertise or experience. This article will explore the process of crafting customized wealth management solutions that are tailored to high-net-worth individuals and their unique financial circumstances.

From asset allocation strategies to long-term tax planning considerations, there are several considerations that need to be taken into account when designing customized wealth management solutions for high-net-worth individuals. Additionally, this article will explore the importance of understanding an individual’s financial goals and risk tolerance when crafting an effective wealth management strategy.

Understand the Needs of High-Net-Worth Individuals

High-net-worth individuals, also known as HNWIs, have financial needs that may differ from the average person. When creating tailored wealth management solutions for this particular demographic, it is essential to understand their goals, lifestyle, and background.

HNWIs are defined as individuals with investible assets valued at upwards of $1 million. These individuals typically have complex financial needs, often including holding a large number of different assets in various industries. It is essential to create a complete plan that takes these many facets into account. Solutions should be tailored to their individual needs, goals, and objectives.

Financial advisors should have a comprehensive understanding of the HNWI’s financial status and preferences. They must examine all of the investment options available and make recommendations that take into account possible tax planning, asset allocation, estate planning, and risk management.

Goals of High-Net-Worth Individuals

Essentials to creating tailored wealth management solutions for HNWIs include understanding the following:

- The individual’s current and expected lifestyle needs.

- Their goals; both long-term and short-term.

- Their risk profile; risk appetite and risk tolerance.

- Legal and tax considerations, among others.

High-net-worth individuals often have diverse financial needs. It is essential to develop a plan that takes all of their objectives into consideration in order to help them reach their financial goals.

Financial advisors must understand the financial needs and goals of HNWIs in order to provide the best advice and create a customized wealth management solution that is tailored to the individual’s needs. By doing so, financial advisors can help these individuals reach their financial goals while ensuring that their portfolio is well diversified and organized efficiently.

Designing Effective Wealth Management Strategies

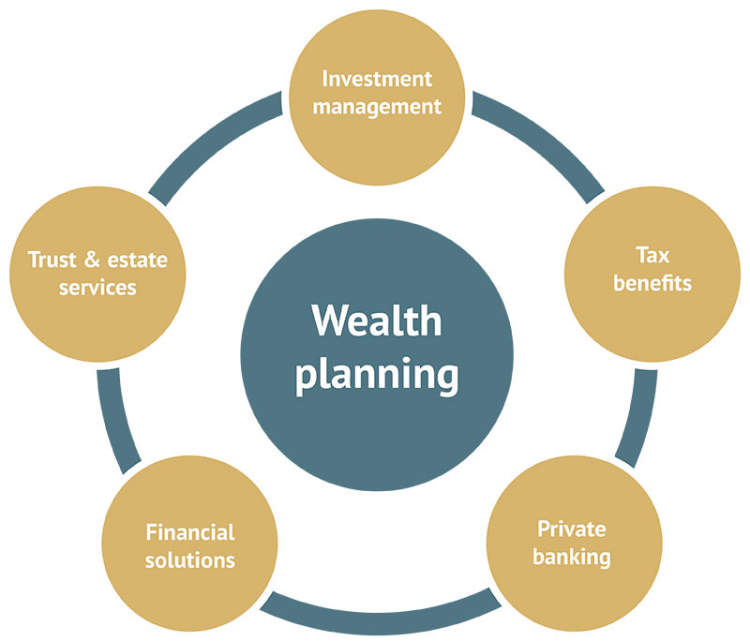

Wealth management strategies encompass a wide range of services and financial products that provide advice and assistance to wealthy individuals in managing their financial assets. Designing effective strategies is critical for high-net-worth individuals in order to meet their financial goals and protect their wealth.

When designing a wealth management strategy for affluent individuals, it is important to consider the goals and objectives of the individual. Each individual will have different needs, from tax optimization to portfolio diversification to legacy planning. By understanding the needs and goals of the individual, wealth advisors can create tailored wealth management solutions that best meet the individual’s needs.

In designing a wealth management strategy, there are several key components to consider, including:

- Investment and Asset Allocation: Asset allocation and diversification are critical components of a well rounded portfolio. Wealth advisors can assist in developing an investment strategy that helps the individual meet their financial goals while minimizing risk.

- Tax Planning and Optimization: High-net-worth individuals can benefit significantly from proper tax planning, as taxes can significantly reduce one’s wealth. Wealth advisors can assist in developing tax strategies that minimise the amount of taxes owed.

- Risk Management: Proper risk management is critical in protecting an individual’s wealth. Wealth advisors can help to develop strategies to reduce and manage risk.

- Legacy Planning: Legacy planning can be an important component of wealth management for high-net-worth individuals. Wealth advisors can help to develop a strategy to ensure that an individual’s assets and wealth are passed on in a tax-efficient manner.

With the right strategies in place, wealth advisors can help high-net-worth individuals create tailored wealth management solutions that protect and grow their wealth. By understanding the individual’s goals and objectives and focusing on the key components of wealth management, wealth advisors can create strategies that meet the individual’s needs and help them to achieve financial success.

Implementing Customized Solutions for Maximum Benefit

High-net-worth individuals experience unique challenges and opportunities when investing and managing their wealth. With such a large portfolio size, having the right set of solutions tailored-fit for their financial goals is of utmost importance.

Successfully executing and implementing this is where most high-net-worth individuals struggle. It takes a certain level of knowledge to understand how to optimize their wealth in the most effective way.

In this vein, implementation of tailored wealth management solutions is of critical importance. Doing so unlocks maximum benefit from the available resources and tools, enabling individuals to securely grow to meet their financial goals.

Some of the key benefits of customized wealth management solutions include:

- Exposure to a wide range of investing options.

- A deeper comprehension of financial planning.

- The ability to create a portfolio tailored-fit for personal objectives.

- Maximized return on investments.

- Lower costs.

Creating tailored wealth management solutions for high-net-worth individuals can be a daunting task, but with the right financial advisor, it is entirely achievable. Finding an advisor who is knowledgeable in the latest financial concepts and experienced in dealing with large portfolios can help make the process much smoother.

Additionally, professionals can also leverage a variety of modern fintech tools and features to enable customized solutions for maximum benefit. These include automated risk management solutions, personalized tax advice, and customized portfolio construction and monitoring.

Conclusion

Wealth management for high-net-worth individuals has become a complex challenge. Financial advisors must be selective about the services they offer in order to provide the best tailored solutions. Many technology solutions are being developed to streamline the wealth management process, which gives individuals the confidence that their wealth is being managed effectively.

It is critical for high-net-worth individuals to be proactive in managing their wealth. And, by creating tailored solutions, financial advisors can provide the tailored solutions needed to suit each individual’s needs. With the right expertise and the latest technology, financial advisors can create reliable and efficient tailored wealth management solutions for high-net-worth individuals.