Having a solid financial plan is essential to achieving long-term goals. Investing in long-term financial planning can provide many benefits from increasing savings and protecting against inflation to receiving tax benefits.

Investing in long-term financial planning ensures that you have a secure financial future. It also provides the opportunity to reap the benefits of compound interest and tax incentives. With the right strategy, these benefits can be utilized to secure a comfortable retirement lifestyle.

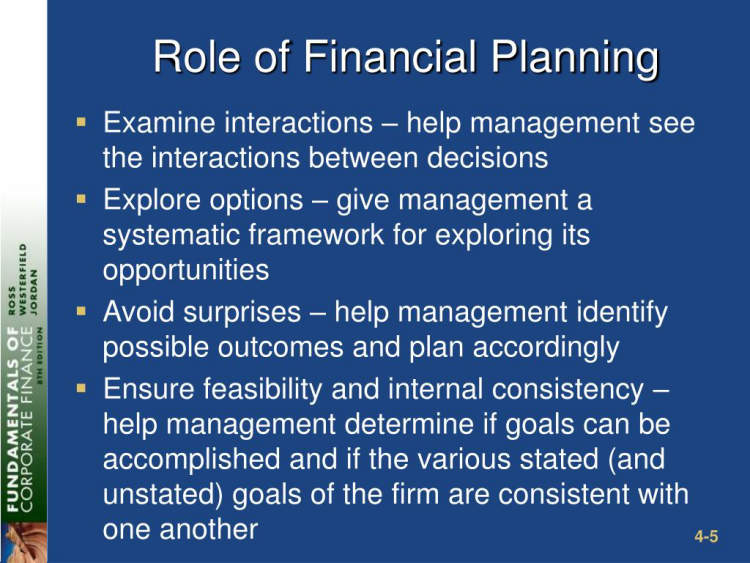

Understanding Long-Term Financial Planning

When it comes to setting up personal finance, long-term financial planning is a must. It entails creating a budget, investing wisely, preparing for retirement, and protecting your assets in a secure, tax-efficient manner. In other words, it’s a process of setting up your financial life in order to secure your future. Here are the components that you need to understand for successful long-term financial planning.

Setting up a budget

Creating a budget puts you in control of your finances. Determine your financial goals and allocate resources accordingly. Make sure to include a savings plan that allows you to set aside some money each month for emergencies and long-term investments. A budget should also account for expenses, such as rent or mortgage payments, food, clothing, utilities, car payments, and other expenses. Finally, use the budget to track your spending each month.

Investing wisely

Investing is a key component of any long-term financial plan. Don’t attempt to make risky investments that you don’t fully understand. Instead, focus on low-cost, diversified investments, such as stocks, bonds, and mutual funds. Consider the amount of risk you’re willing to accept and make sure to do your research before investing. Consider the investment objectives, risk tolerance, and investment timelines.

Preparing for retirement

Retirement planning is an important element of any financial plan. Depending on your age and how much time you have left to save for retirement, you will need to plan accordingly. Investing in retirement accounts, such as a 401K or IRA, can be a great way to save for retirement. Additionally, you may wish to consider investing in other types of savings such as annuities or life insurance policies.

Protecting your assets

Finally, it’s important to ensure that your hard-earned assets are protected in the event of a disaster or mishap. Consider setting up a trust, purchasing insurance, and setting up appropriate legal documents such as wills and powers of attorney.

In conclusion, long-term financial planning is essential for ensuring your financial security. Take the time to understand the components of such planning and invest in the future of your financial life.

Reasons to Start Investing in Long-Term Financial Planning

Long-term financial planning offers many benefits to individuals. It helps to provide financial stability and security for the future, and can help to make your financial goals a reality. Here are some of the reasons to start investing in long-term financial planning:

Flexibility

Long-term investments offer more flexibility than short-term investments. There is flexibility in how much is invested, when the funds are invested, and in the types of investments used. This allows individuals to create a tailor-made plan that meets their specific financial goals over a longer period of time.

Compound Interest

Compound interest is a powerful financial tool. It allows your investments to earn interest on their own interest over a period of time. This type of interest grows exponentially, as the compounded investments increase in addition to the original amount.

Financial Security

Long-term investments give you the financial security you need for unexpected events or emergencies. This way, you don’t have to worry about accessing your emergency funds when the situation arises. Instead, you can simply focus on taking care of the issue and still have the necessary funds available.

Tax Benefits

With long-term investments, you may also benefit from tax advantages. Depending on the type of investment, you may be eligible for lower taxes or tax deductions. This could lead to significant savings at the end of the tax year.

Diversification

Diversification is an important part of any investing strategy. By diversifying your investments, you reduce your risk and protect yourself from potential losses in any one area. Long-term investments allow you to diversify your portfolio and spread out your risks across multiple investments.

Goals and Objectives

The most important benefit of long-term financial planning is that it allows you to better plan your future. By investing in your future now, you can work towards your short and long-term goals in a much more efficient manner. With a well-thought out financial plan, you can work towards achieving your goals and objectives for many years to come.

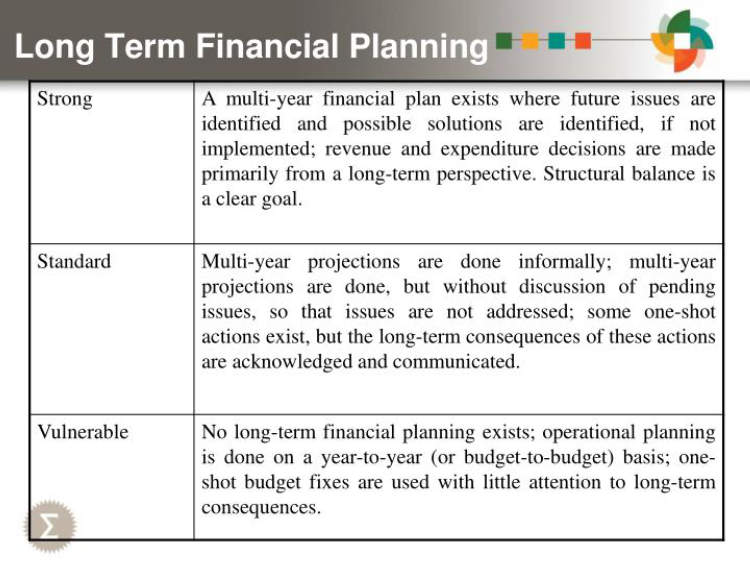

Planning for the Future with Long-Term Financial Planning

Long-term financial planning is an important part of any individual or family’s overall financial plan. It helps you make informed decisions about how to manage your finances both now and in the future. By planning for the future, you can reduce stress and anxiety, as well as build financial security.

When creating a long-term financial plan, it’s important to take into account both your short-term and long-term goals. You should also consider how your current lifestyle and income will affect your long-term plans. Consider what type of investments you’d like to make, as well as any plans you have for retirement, college tuition, or a hefty inheritance.

The Benefits of Investing in Long-Term Financial Planning:

- Protects against financial risks, such as inflation.

- Helps you achieve your financial goals.

- Enables you to plan for retirement and other long-term goals.

- Can help you make more informed financial decisions.

- Provides you with peace of mind and financial security.

Long-term financial planning is a key part of any financial plan, and can help you achieve financial freedom and security, as well as increased peace of mind. Although it can take some time and effort to set up, the rewards and stability that long-term financial planning can provide make it a worthwhile investment.

Conclusion

Long-term financial planning has a plethora of benefits associated with it. With a well-thought-out plan, you can protect yourself financially, reduce your tax burden, build toward retirement goals, and minimize the disruption of life events on your finances. It can also give you peace of mind, knowing that your financial future is taken care of.

To get started with long-term financial planning, it is best to consult with a financial advisor or accountant to discuss what options are right for you. They can guide you through the process and provide valuable advice on the best strategies for your situation. With the right help and guidance, you can make the best decisions for your financial future and enjoy the numerous benefits that come with it.