Building wealth through investment is an important part of long-term financial security. Having an effective strategy to pursue your wealth goals is an important step to remaining on track and being organized. To this end, diversified investment approaches can be a great starting point.

Here are five strategies for building wealth through diversified investments that you can use to create your own unique approach to growing wealth over time:

What is a Diversified Investment Approach?

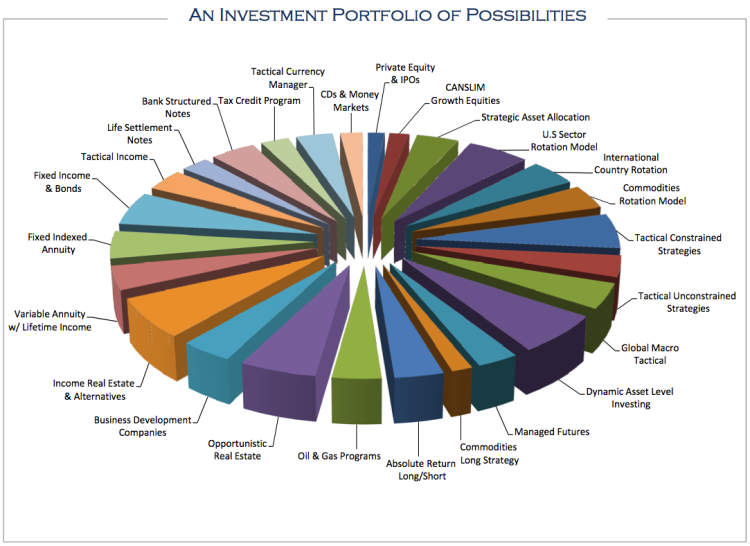

Diversified investing is a strategy used by investors to diversify their portfolios. It involves investing in a variety of investments, such as stocks, bonds, mutual funds, real estate, and other investments. By diversifying across different asset classes, investors reduce their risk of losses from any one type of investing. The goal is to achieve a balanced portfolio that will minimize the total risk and maximize the potential for growth.

An effective diversified investment approach requires careful planning. Investors must consider their objectives, risk tolerance, and time horizon. They should also be aware of potential risks associated with different asset classes. After assessing these factors, an investor can choose the ideal combination of investments from various asset classes that will properly diversify their portfolio.

Below are five strategies investors can use to build wealth through diversified investment approaches.

5 Strategies for Building Wealth through Diversified Investment Approaches

- Set Goals and Create a Plan. To achieve any kind of financial success requires planning and setting realistic goals. Developing a long-term strategy begins with setting a plan and refining it along the way.

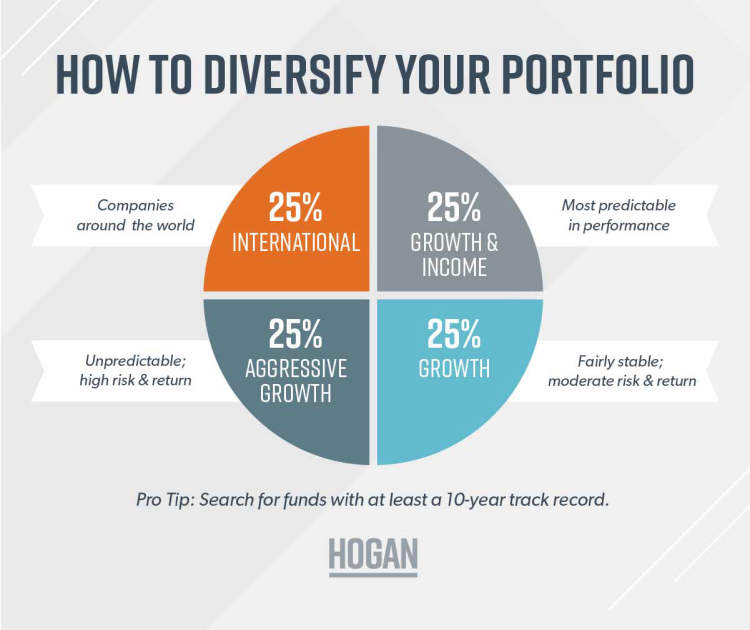

- Diversify Your Portfolio. You don’t want to put all your eggs in one basket, so diversifying your portfolio will help you spread out the risk. Explore different asset classes, such as stocks, bonds, mutual funds, real estate, and more.

- Select Low-Cost Funds. When investing in mutual funds, select funds with low fees and expenses. This will help you keep more money in your pocket, allowing for a greater potential for returns.

- Manage Risk. Risk management is an essential part of any investment strategy and helps protect your portfolio against sharp declines. Be sure to diversify your investments to reduce risk.

- Monitor and Adjust Your Portfolio. Monitor your investments closely and adjust your strategy as necessary. This will help you remain flexible and maximize your returns.

Ways to Invest in Diversified Assets

If you want to ensure the most secure future and build wealth effectively, diversified investments are the way to go. Diversification allows you to spread out your risk among several assets, reducing your exposure to one particular asset class. By having a mix of different investments with a variety of types, you are better positioned to benefit from market gains and withstand significant losses. Here are some ways to diversify your investment portfolio.

Stocks

Buying stocks is one of the most popular ways to diversify your investments. Stocks, also known as equities, represent ownership in a company or business. When you purchase stocks, you become a shareholder, which makes you eligible to receive dividends or profits that the company makes. Stocks also have the potential to appreciate in value over time, allowing investors to gain a return on their investment. It’s important to keep in mind that stock market investments can be highly volatile and may lead to significant losses.

Bonds

Bonds are debts issued by governments, companies or entities. When you buy a bond, you are essentially lending money to the issuer and receiving regular interest payments. Bonds are typically seen as less risky than stocks, but they still offer the potential for higher returns than savings accounts or money market accounts. It is important to consider the risks associated with the issuer of the bond when making your decision to invest.

Mutual Funds

Mutual funds are an investment option that allows you to pool your money with other investors and buy a range of different assets—stocks, bonds, or a mix of both. Mutual funds offer a simple and cost-effective way to diversify your investments and benefit from professional asset management. One important factor to remember when investing in mutual funds is that you’ll need to pay a percentage of any gains to the fund manager.

Exchange-traded Funds (ETFs)

Exchange-traded funds are similar to mutual funds in that they allow you to invest in a variety of assets. ETFs are typically cheaper to buy than mutual funds, and they can be bought and sold like stocks. However, ETFs do not offer the same level of professional asset management as mutual funds, so you need to be sure you understand the risks involved in each type of ETF before investing.

Real Estate

Real estate can be a great way to diversify your portfolio and provide an ongoing income stream. With a real estate investment, you buy a property and rent it out for income or you can buy and hold the property to sell it later for a profit. The downside to investing in real estate is that it requires more effort and capital than investing in other types of assets.

By investing in a mix of stocks, bonds, mutual funds, ETFs, and real estate, you can diversify your investments and reduce your risk. However, it’s important to remember that investing in any type of asset carries some level of risk, so be sure to do your research and understand how each type of asset works before investing.

Benefits of Diversified Investment Strategy

A diversified investment strategy is considered essential for investors who are looking to maximize their current and long-term returns. It is especially beneficial in a time of market uncertainty, as it helps spread the risk among multiple investments and industries. By diversifying your investments, you reduce the chance of losing a significant portion of your capital due to a single poor performing asset. Here, we outline five strategies for creating wealth through a diversified investment mix.

Some of the benefits of diversified investment include:

- Reduced risk of total portfolio loss due to unfavourable market conditions

- Potential to maximize returns as investments are spread across numerous closely monitored assets

- Protection against major events impacting one sector or asset class

- Greater disciplinary approach as decisions are not based on emotion or timing

- Increased scope for long-term capital gains by investing in growth markets

Overall, diversification enables investors to reduce risk and take advantage of the opportunities that are available in different markets. It also helps investors to remain focused and disciplined throughout their investment journey.

Conclusion

Having a diversified approach to investing is aKey strategy for building wealth. Diversifying investments by asset class, market and risk can help reduce volatility and maximize returns. Investing in different asset classes helps to increase the chance of a positive outcome regardless of the direction of the markets and can help you make the most of money that exists on different markets.

Finally, understanding the markets, having a sound risk management plan, diversifying investments and allocating resources wisely are important elements for building wealth that Last. Keeping an eye on fluctuations in different markets and striving to achieve balance between risk and expected return can help investors enjoy success in the long-term.