Cryptocurrency has become a much talked-about phenomenon in recent years. For many people, it’s a thrilling prospect that offers the promise of anonymity, decentralization, and the potential for huge profits. But behind the glitz and glamour, cryptocurrency is also surrounded by risks – and you need to understand them to make informed decisions on whether to invest.

This article looks at what cryptocurrency is, the risks associated with it and the opportunities it offers. We’ll answer questions like: what’s the most popular cryptocurrency? What can you buy with cryptocurrency? What is the future of cryptocurrency, and is investing in it worth it? By the end, you’ll have a better understanding of the dangers and rewards that come with cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a form of digital currency created and secured by cryptography techniques. It is not issued by any government or managed by any financial institution. Instead, cryptocurrency is managed by a series of computers distributed and connected over the internet, often called as blockchain. The security of cryptocurrency transactions is kept up by the use of complex coding and encryption. As opposed to traditional currency, cryptocurrency is not affected by inflation or financial regulations.

Cryptocurrency has opened up a variety of new opportunities in business, finance, and investments. While it can be a valuable asset, it also carries certain risks due to the lack of government oversight and the anonymous nature of transactions. For investors looking to take advantage of this new asset, it is important to understand the risks associated with cryptocurrency as well as the opportunities.

In this article, we will discuss the basics of cryptocurrency, how it works, the risks associated with it, and the opportunities available for investment. By understanding the nature of cryptocurrency, investors can be better prepared to take advantage of the opportunities offered by this new asset.

How Does Cryptocurrency Work?

Cryptocurrency works through the use of cryptography and blockchain technology. Cryptocurrency transactions are managed through a distributed ledger – the blockchain – that is constantly being updated and verified by many computers located around the world. Each transaction involves the exchange of cryptocurrency for goods or services and is recorded on the blockchain in an encrypted form. Transactions are also verified by the network of computers and once a transaction is verified, it is permanently stored in the blockchain.

What are the Risks Associated With Cryptocurrency Investments?

As with any investment, there are certain risks associated with cryptocurrency investments. Some of these include:

- Price volatility: The price of cryptocurrencies can be highly volatile, making it difficult to accurately predict the market and anticipate price changes.

- Lack of regulation: Since cryptocurrency is not regulated by any government or institution, there is no guarantee that it will not be subject to manipulation or fraudulent activities.

- Hackability: Cryptocurrencies are vulnerable to hacking and security breaches due to the lack of government oversight.

- Tax implications: Gain or loss on cryptocurrency investments are subject to taxation, and investors must be aware of the regulations and laws governing taxes in their respective country.

What are the Benefits and Opportunities of Investing in Cryptocurrency?

Despite the risks, there are many potential benefits and opportunities of investing in cryptocurrency. These include:

- Decentralized and global: A decentralized system, cryptocurrency offers global accessibility and freedom from censorship by governments or institutions.

- Low transaction fees: Most cryptocurrencies offer lower transaction fees compared to traditional payment methods, making them more attractive for businesses and individuals.

- Ease of use: With the emergence of cryptocurrency wallets and mobile applications, it is easy to buy, sell, and store cryptocurrencies.

- Investment potential: Cryptocurrencies have seen tremendous growth in recent years and often provide a large return on investment compared to traditional investments.

Understanding the Risks of Cryptocurrency

Cryptocurrency is rapidly gaining traction in the financial world but there are certain risks associated with its use. Exploring the world of cryptocurrency can be incredibly exciting, but it’s important to understand the risks involved. Crypto operates on a digital protocol which lack real-time regulation and are highly volatile in nature making them very risky investments.

When investing or trading cryptocurrency, it’s crucial to know the risks. Here are some of the primary risks that come with investing in or trading cryptocurrency:

- Volatility: Cryptocurrency prices can be highly volatile, and market prices tend to fluctuate as a result of speculation and news. This volatility can cause significant losses if not managed properly.

- Security: Cryptocurrency transactions are irreversible, and users may be vulnerable to theft of their funds through hacking, scams, and malicious actors.

- Regulation: Cryptocurrencies are not regulated by governments, and financial institutions do not necessarily recognize or accept them as a valid form of payment.

- Exchange risk: Cryptocurrency exchanges are prone to cyber-attacks and other threats that can cause wide swings in the prices of cryptocurrencies.

It’s important to understand the risks involved before committing to any type of cryptocurrency investment. While it’s possible to make significant profits with cryptocurrency, it’s important to remember the risks involved and take all necessary precautions.

Exploring the Opportunities of Cryptocurrency

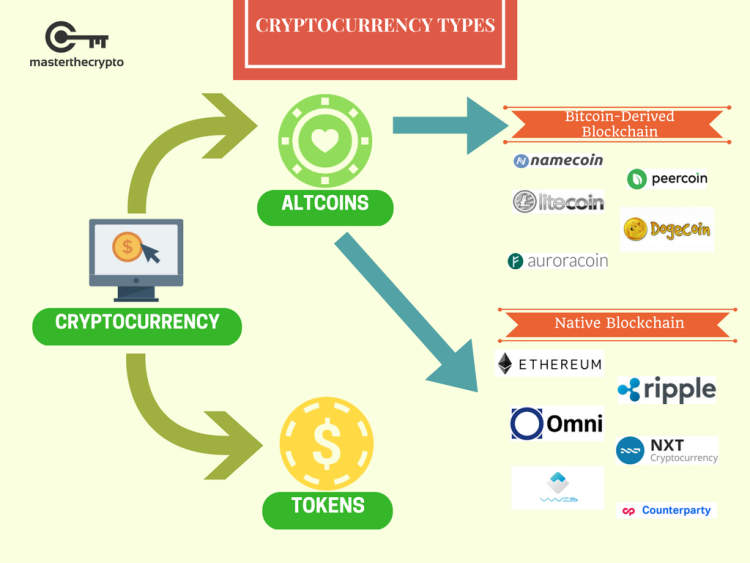

Cryptocurrency is a form of digital currency that has enabled digital transfers of value between users worldwide. It is created and maintained by a decentralized network of computers running a specialized software. As of today, there are numerous forms of cryptocurrency, and each of them has its own unique characteristics. These characteristics help determine the potential opportunities available to anyone investing or using cryptocurrency.

Cryptocurrency can provide financial products and services that would otherwise be difficult to procure. This includes sending and receiving money anywhere in the world in an instant, which is made more convenient by the low transaction fees often associated with cryptocurrency. Additionally, cryptocurrency can also provide users with the ability to transact and receive payments anonymously. This feature of cryptocurrency has attracted a lot of users who use it for various activities, such as purchasing goods or services that would otherwise be difficult to acquire with traditional currencies.

Another advantage associated with cryptocurrency is its potential to act as an investment vehicle. Investors have the potential to make a profit by buying and selling various cryptocurrencies. Many investors also opt to invest in cryptocurrency funds, which allow users to invest in a portfolio of various currencies. In some cases, investors can also use leverage when investing in cryptocurrency, allowing them to take on more risk and potentially increase their returns.

In addition to potential for financial gain, cryptocurrency also offers an array of benefits to users. For instance, cryptocurrency transactions are secure and immutable, meaning that they cannot be reversed or changed. This ensures that users can safely store and transfer their funds, making cryptocurrency a secure way to transact. Additionally, cryptocurrency transactions are often fast and inexpensive, eliminating the need to pay expensive fees while sending money worldwide.

Ultimately, the potential of cryptocurrency is vast and there are numerous opportunities available to users who know how to take advantage of it. From making financial investments to using it for various transactions, cryptocurrency offers users many potential advantages. It is important to understand the risks associated with cryptocurrency, however, before embarking on any venture. By researching the various opportunities available and familiarizing oneself with the risks, users can gain the knowledge to help them explore the world of cryptocurrency.

Conclusion

Cryptocurrency is a fascinating new world of opportunities and risks. Through research, education, and due diligence the consumer can make informed decisions about engaging in cryptocurrency activities. Setting up a wallet, determining what currencies to invest in, and studying the market is essential before investing. Ultimately, as the cryptocurrency market continues to grow and change, it is perhaps most important to keep up with news and stay updated on the industry as a whole.

Cryptocurrency offers potential to gain returns, as the digital currencies have increased in value. However, a well-educated investor also understands the risk involved and the need to diversify their portfolio appropriately. A good way to get started with cryptocurrency is to start small and gradually increase investments over time as the investor’s knowledge increases. With a better understanding of the opportunities and risks associated with cryptocurrencies, one can make better decisions when it comes to investing.