With the rise of the gig economy, an increasing number of individuals are exploring ways to make money through passive income streams. These are methods of making money that require minimal input and, in some cases, can make you money while you sleep. In this article, we’re taking a closer look at why so many individuals are exploring the possibilities of passive income streams and how you can create stability for yourself beyond traditional earning.

Passive income streams are rapidly gaining traction as an alternative way to make money over traditional methods. In addition to providing an additional source of income, passive income often offers individuals the opportunity to pursue their passions and hobbies. By creating passive income streams, you can potentially eliminate a lot of the stress found in traditional earning.

Introducing Passive Income Streams

Creating financial stability for yourself is an important part of life and can be especially difficult if you rely solely on consistent employment. Fortunately, with passive income streams, anyone can add to their regular earnings and create a long-term solution for attaining a stable livelihood.

Passive income streams involve sources of income that do not require daily attention and are often generated while you’re doing other tasks or engaging in activities. Some of the most popular ways to create passive income include:

- Investing in stocks and real estate.

- Creating rental properties.

- Setting up an online store.

- Joining an affiliate program.

- Starting a podcast or blog.

It can take a bit of patience and dedication to get a passive income stream up and running, but the rewards can be great. Not only can you supplement your earnings, but you can also create reliable financial stability for the long-term.

Benefits and Drawbacks of Passive Income Streams

Passive income streams are a great way to create additional and consistent revenue all while you focus your attention on other areas. Although passive income streams can be a great way to secure your financial future, they come with many benefits and drawbacks that you should know.

Benefits:

One of the main benefits of passive income streams is the less amount of effort required for steady income. Instead of toiling away at a job all day for a single, one-time paycheck, you will have the potential to earn income continually through rental investments. As a result, you will have more time and energy to spend on other investment opportunities. Additionally, passive income streams will always be with you, no matter what happens to the stock market or other economic conditions.

Drawbacks:

Even though passive income streams can provide large amounts of money with minimal effort, there are some drawbacks that come with them. One of the most significant of these drawbacks is the possibility of slow income. Many times, investments need time to appreciate before they start producing a steady stream of income. Additionally, there may be extensive setup and maintenance costs associated with your passive income stream. It is also important to remember that passive income streams are not for everyone, and require a certain amount of capital to start.

Overall, passive income streams can be a great way to secure your financial future, but they come with a set of advantages and disadvantages that must be taken into account. When properly planned and managed, passive income streams can provide a safe and reliable source of revenue.

Developing Passive Income Streams for Stability

When it comes to building financial stability, passive income streams are one of the most reliable methods. With this type of income, money is generated with minimal effort or upfront costs on an ongoing basis. This can be an important step towards financial independence and security, especially for those who are self-employed, retired, or looking to supplement their existing income.

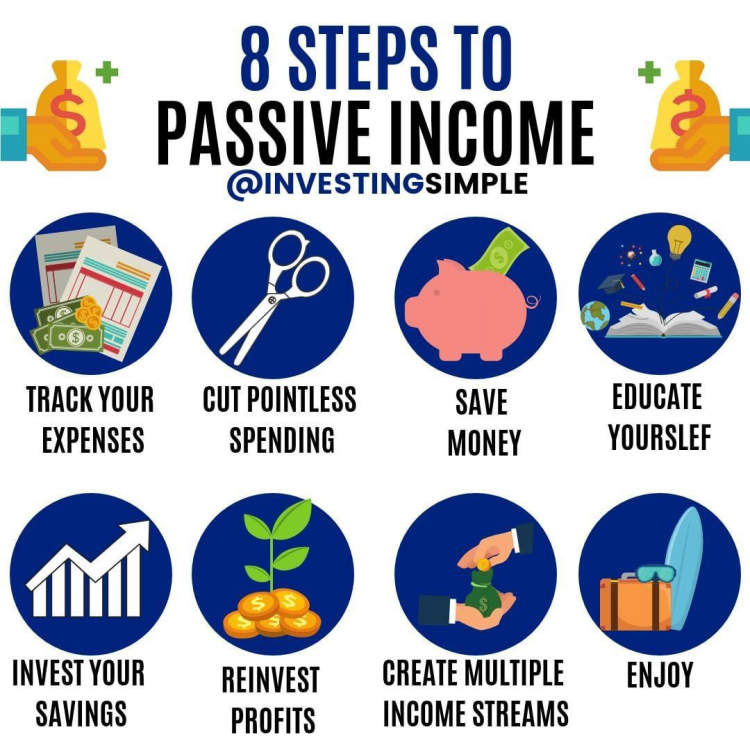

Exploring ‘passive income streams’ is a great way to create a more secure source of income and achieve financial stability. There are many different types of passive income sources including investments, rental income, royalties, and the budding sharing economy. Here are a few tips for exploring these streams and starting your journey towards financial security:

1. Evaluate Your Financial Status

Before considering any type of passive income streams, it’s important to get a full picture of your existing finances. Knowing how much money you have available to invest, your current monthly expenses, and other debts will help you determine your risk tolerance and how much passive income you should strive for.

2. Research Possible Income Streams

Once you have an understanding of your financial standing, it’s time to begin researching potential income streams. There are a variety of investment options, such as stocks, mutual funds, or online brokers, as well as the sharing economy and other online services. Understanding the risks and returns associated with each type of options is important to ensure that you are maximizing your potential returns.

3. Create a Plan and Stick to It

It’s important to be realistic when it comes to passive income streams. Don’t expect a get-rich-quick scheme, as developing financial stability takes time and dedication. Put together an actionable plan with measurable goals, and make sure to not over extend yourself financially.

4. Monitor Your Progress

When it comes to passive income streams, proper planning and monitoring are key. Don’t forget to periodically check in on your passive income streams to see if there are any adjustments that need to be made to maximize your earnings.

5. Utilize Automation Tools

Finally, consider utilizing automation and other digital tools to reduce your overall workload and free up more time for yourself. Automation tools can be used to streamline payments, track expenses, and even remind you when bills are due, making it easier to manage your passive income streams.

Investing time and effort into exploring the various passive income streams available can pay off in the long run. Keeping these tips in mind, as well as creating an actionable plan and monitoring your progress, can help you along your journey to achieving financial security and stability.

Conclusion

At the end of the day, “passive income streams” offers a valuable means of generating an additional income. These income streams are ideal for providing a steady stream of income and can lead to greater financial stability. As with many endeavors, there are some risks involved with setting up passive income streams. However, with care and preparation, you can start to take advantage of all the benefits that creating passive income streams can provide.

By researching and effectively executing passive income streams, you can greatly expand your financial capabilities and allow yourself more options for spending and saving. Although not a complete replacement for your traditional employment, exploring “passive income streams” can be a great way to create financial stability for yourself and give you the financial boost that you need.