Having a good credit score is essential for your finances. It can open many financial doors, such as purchasing a home, getting access to low-interest rates on loans and bank accounts, and higher credit limits. You could even qualify for better insurance rates. A low credit score can hold you back from pursuing some of life’s biggest goals.

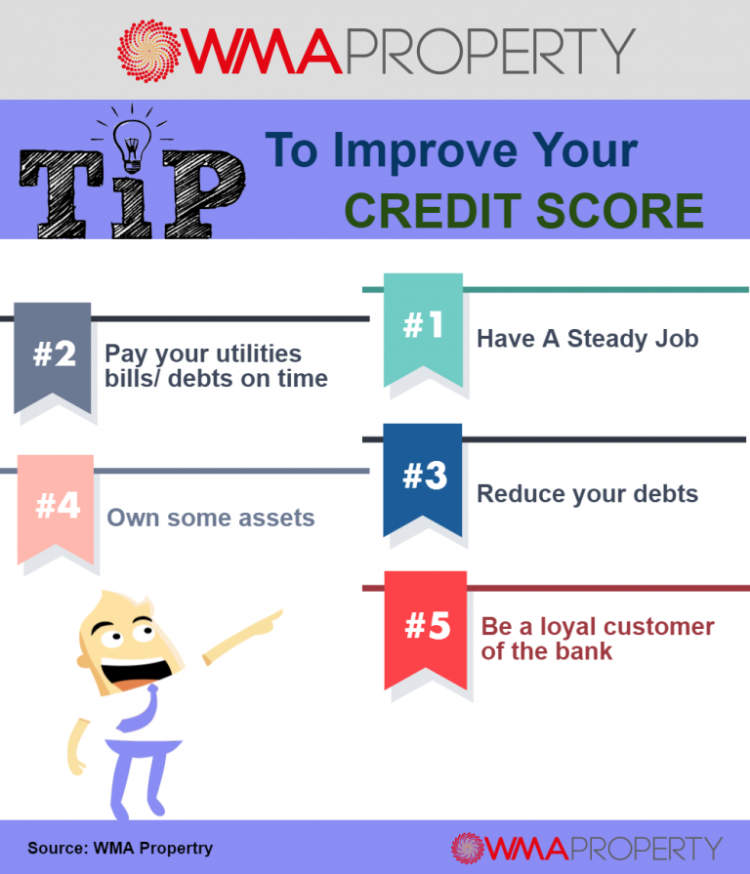

But raising your credit score isn’t as daunting as it may seem. Following these 8 simple steps are a great start in improving your credit score and enhancing your reputation with lenders. Here’s how you can get started:

Understand Your Credit Score and Learn How It Works

Your credit score is one of the most important factors that lenders use to decide whether or not to approve your application. It is important to understand how credit scores work and how to improve yours. Fortunately, with a few simple steps, you can benefit from higher credit scores and create a more financially-sound future.

Your credit score is based on five major factors: payment history, credit utilization, length of credit history, mix of credit types, and new credit. Lenders use these factors to determine your creditworthiness, which in turn can affect your loan approval, loan rate, and other financial decisions. If you want to have a good credit score, it’s important to maintain a healthy credit score.

Here Are 8 Simple Steps To Improve Your Credit Score:

- Check your credit report for errors.

- Pay your bills on time, every time.

- Keep your credit utilization rate low.

- Don’t open too many new accounts or apply for too many loans.

- Be mindful of your debt-to-income ratio.

- Be aware of hard inquiries.

- Use a secured credit card to rebuild your credit.

- Monitor your credit score and report regularly.

Once you understand your credit score and how it works, you can use the aforementioned eight steps to improve it and enhance your financial reputation. Be sure to pay your bills on time and keep your credit utilization rate low for an optimal credit score. Lastly, make sure to monitor your credit score and report regularly to ensure you have an accurate understanding of the changes to your credit score.

Check Your Credit Score Regularly and Monitor Your Financials

When it comes to maintaining good financial health, checking your credit score regularly is an essential part of the process. An important factor in your credit score is the types of credit accounts you have, how many, the amount, and how your payments are managed over time. Tracking your credit score can help you identify errors in your report that could be bringing it down, and manage it more carefully. In addition, monitoring your financials allows you to stay on top of any changes in your financial health, as well as any debt or loan payments you may have.

In order to maintain a good credit score, monitoring your financials must go hand in hand with regular checks of your credit report in order to make sure no negative errors appear. Here are some simple steps you can take to improve your credit score and enhance your financial reputation:

- Check your credit score on a regular basis. Do this at least once a year, but preferably more often. Requesting your credit report from each of the three main credit bureaus is important, as they may report differently.

- Make sure to pay credit card balances in full and on time. This helps to build positive credit and avoids late fees.

- If you’ve made mistakes in the past, make sure to dispute those entries and file for corrections as soon as possible.

- Reduce your debt and avoid opening too many credit accounts.

- Use credit responsibly, meaning Credit Utilization (30% of your overall limit).

- Monitor your financials by setting up a budget and tracking your spending.

- Make payments on time and set up automated reminders.

- Work with a credit repair specialist for more tips and advice on how to improve your credit score.

Making credit score and financial health a priority can make a huge difference both in the short and long term. Set up reminders and make this part of your monthly habit, and you’ll be on your way to building your financial reputation.

Pay Your Bills On Time and Keep Balances Low

Are you looking for simple steps to improve your credit score and enhance your financial reputation? The key is to pay your bills on time and keep balances low. If you follow these two simple rules, you’ll put yourself in the best position to obtain a higher credit score and gain more respect for your financial standing.

Paying your bills on time is extremely important. How expensive can an occasional late payment be? The answer is more costly than most people think. Even a couple of late payments can cause your credit score to drop significantly. That’s why it’s important to set reminders for each of your bills so that you never miss a due date.

In addition to paying your bills on time, keeping your balances low is also essential. Aim to pay off credit cards every month or keep the balances below 30 percent of your total credit limit. Keeping your balances low helps show lenders that you have financial discipline and a good handle on your finances.

In conclusion, strive to pay your bills on time and keep balances low to improve your credit score and enhance your financial reputation. Following this advice will create a foundation for you to take the necessary steps to improve your financial situation.

Seek Professional Credit Counselling When Needed

When it comes to fixing your credit score, professional guidance can be very helpful. Therefore, seeking professional credit counselling when needed is a wise decision to make. Credit counselling provides unbiased advice and helps you take steps to repair your credit history. You don’t need to consult a credit counsellor every time you’re looking to repair your credit, but it’s worth considering if you have an unmanageable debt or not enough knowledge to make the right financial decisions. Here are some important things to look out for when you decide to consult a credit counsellor.

- Credit Counsellor Qualifications: When selecting a credit counsellor, make sure they are properly qualified, have a good reputation and have enough expertise to help you. It’s best to speak to a few credit counsellors for a consultation, before you commit to one.

- Ask Questions: Ask the credit counsellor plenty of questions to understand their terms and conditions. This will help you build trust with the counsellor, as well as give you a better idea of what working with them will entail.

- Fees: Ask for an estimate of fees for their services. Different credit counsellors will have different fees, so make sure to inquire and compare.

By taking the time to seek professional credit counselling, you can get the assistance you need to improve your credit score and financial reputation. While this may not be the easiest or quickest process, it is a necessary part of rebuilding your credit and enhancing your financial stability.

Debt Consolidation May Help Improve Your Credit Health

Having bad credit affects more than just your ability to secure a loan. A less than stellar credit score can prevent you from renting a house, opening a line of credit, and even holding certain jobs. Improving your credit score isn’t as hard as you think, all it takes is some smart decision-making and dedication. One of the best ways to increase your score is to consolidate your debts. Debt consolidation simplifies the management of your accounts by combining multiple outstanding debts into one monthly payment. The following 8 simple steps will help you consolidate your debt payments and maximize your credit health.

1. Review Your Finances

The most effective way to reduce your debt and improve your credit health is to learn from your mistakes. Review your budget, track your spending and compare it to your current income. Knowing where your money is going will help you create a strategy to reduce your debt and regain control of your finances.

2. Work with Your Bank to Create a Consolidation Loan

Working with your current bank is often the best bet for consolidating your debt, as you’ve already established a relationship with them. Many banks and credit unions offer low-interest debt consolidation loans that can help you combine payments and simplify your budget.

3. Explore Available Payment Assistance

In order to help the American people, the COVID-19 Stimulus package includes various grants and other payment assistance methods. Explore these options to take advantage of potential additional funding to help reduce your debt and improve your credit score.

4. Contact Your Creditors

Your creditors may be willing to work with you if you contact them and explain your situation. Many creditors will be open to creating a payment plan that works for both of you. An established payment plan can reduce your debt and improve your credit score.

5. Create a Repayment Schedule

The best way to keep track of your debt and ensure that you’ll pay it off in a timely manner is to create a repayment schedule. Consolidate all of your payments into one budget and divide up the payments accordingly. You can also consider setting up automatic payments to minimize the risk of missing a payment.

6. Set Up Financial Alerts

Take advantage of automatic text or email alerts to remind you when a payment is due. Alerts will inform you of the upcoming payment and give you time to make the necessary adjustments to your budget.

7. Take Advantage of Balance Transfers

Balance transfers are a great way to reduce the interest on your debt and simplify your budget. If you have good credit, you can apply for a balance transfer card with a 0% intro rate that can help you reduce your debt faster.

8. Make Lifestyle Changes

Sticking to a budget is the best way to ensure you’re spending only what you can afford. Consider reducing your spending on luxury items, eating out less, and creating a savings plan to improve your budget and your credit score. By following these steps, you can successfully consolidate your debts and improve your credit health. It’s important to stick with it and stay motivated to reach your goals. Debt consolidation can help you manage your debts and work towards becoming financially stable again.

Limit New Credit and Know Your Credit Utilization

A credit score is an important aspect in determining your financial reputation. Knowing this, it is important to actively improve your credit score and enhance your financial reputation. Here are eight steps to help you do this:

Step 1: Limit New Credit

One of the most important steps to improving your credit score and enhancing your financial reputation is to limit your application for new credit. When you apply for a new loan or credit card, the lender or credit card company usually reviews your credit report. This interaction results in a “hard inquiry,” which usually lowers your credit score.

If possible, avoid applying for new credit unless absolutely necessary. Whenever you apply for a new loan or credit card, opt for pre-approvals. With pre-approvals, lenders usually don’t need to review your credit report.

Step 2: Understand Your Credit Usage

Your credit utilization is majorly assessed in your credit score calculation. To maximize your credit score, you need to ensure that you don’t get close to charging all your total available credit limit. Creditcards.com cautions that you should aim to keep your usage under 30% or lower.

For instance, if you have a total available credit limit of $10,000, you should aim to keep your monthly charge usage at $3,000 or lower. This helps to boost your credit score.

Keep Up With The Latest Credit Changes & Security Breaches

With the ever-changing world of credit and increasing security breaches, it is important to stay up to date on the latest changes and security. Knowing the credit rules and following best practices can help you protect your financial reputation and make sure your credit score is in the best shape possible.

The following eight simple steps offer guidance in understanding the basics and how to improve your credit score:

- Stay informed on the latest credit rules and updates.

- Know your current credit score by requesting a credit report.

- Check for any errors on your credit report.

- Pay your bills on time.

- Monitor and keep balances low on credit cards.

- Know and monitor your credit limits.

- Know and monitor your credit utilization and payment history.

- Know and report any suspicious activity

By following these eight steps, you can be sure to maintain a good credit score and make sure you are not a victim of identity theft or fraud. Additionally, staying informed on the latest credit rules and any security breaches will empower you to better protect your financial reputation.

Development of Healthy Financial Habits

Developing healthy financial habits is an essential part of maintaining a strong credit score. Poor money management may lead to overdue bills, which can affect your credit score. It is important to ensure that your finances are in order to maintain a good credit score and reputation. Some simple steps you can take to improve your credit score and manage your finances include:

- Creating a budget

- Setting financial goals

- Understanding the difference between needs and wants

- Tracking income and expenses

- Paying bills on time

- Planning for long-term goals such as retirement or college education

- Reducing or eliminating unnecessary debt

- Limiting credit inquiries and avoiding too much debt

By creating a budget and setting financial goals, it will be easier to manage your finances. Additionally, tracking your income and expenses will help you stay on top of your finances and ensure that you are not spending more than you can afford. Paying bills on time, planning for long-term goals, reducing debt, and limiting credit inquiries will all help to maintain a good credit score and reputation. Following these simple steps will help you develop healthy financial habits and improve your credit score.

Conclusion

Improving one’s credit score and enhancing their financial reputation is an ongoing process. Fortunately, with the right strategy and mindset, you can easily make significant progress. By following these 8 simple steps, you will be on your way to boosting your credit score and building financial credibility.

It takes effort and discipline to maintain a good credit score. However, by taking preventive measures and being proactive with your finances, you can ensure that your credit score remains in good standing while maintaining a good financial reputation.