As the trend of saving for retirement increases, many investors are turning to diversified mutual fund portfolios to diversify their investments and maximize their returns. Diversified mutual funds offer several advantages, including the ability to diversify your assets while minimizing risk. This article will explore the advantages of diversified mutual fund portfolios and why investors should consider them for their retirement planning.

Investing in mutual funds is one of the best opportunities for investors to diversify their portfolios. With a diversified portfolio, investors are able to spread their investments across a variety of funds which focus on different asset classes. This strategy enables investors to protect their money from market volatility while still maintaining the potential for long-term gains. Additionally, diversified funds reduce the overall risk of a portfolio because the individual fund performance can help balance the good and bad performance of other funds in the portfolio.

Overview of Mutual Fund Portfolios

Mutual funds are investment funds that are managed by a professional money manager. They are made up of pools of money invested in various different types of securities such as stocks, bonds, and other financial instruments. Generally, mutual funds are diversified investments that afford investors the ability to gain low-risk exposure to a wide range of markets and asset classes.

Investors can also choose to add a diversified mutual fund portfolio to their existing investment strategies. This allows investors to further diversify and manage risk over a broader array of asset classes. For investors looking to diversify their investments, here are some of the benefits of a diversified mutual fund portfolio.

Advantages of Diversified Mutual Funds

- Diversification: Mutual funds provide investors with the opportunity to diversify across multiple markets and asset classes. As a result, investors can reduce their risk exposure to any one asset class or market segment. This improves the potential for return on investments over the long-term.

- Access to Professional Management: Mutual funds are managed by highly trained and experienced portfolio managers. These professional money managers are well-versed in the markets and have access to the latest information and analysis. As a result, investors can be more confident in their investments as they are managed by experts.

- Liquidity: Mutual funds are highly liquid investments, meaning that investors can easily access their money without incurring additional trading costs or penalties. In addition, many mutual funds are traded on major exchanges, providing investors with the ability to buy or sell whenever they desire.

- Low Management Fees: Many mutual funds have relatively low management fees, allowing investors to maximize the potential return from their portfolio. As a result, investors can reap the benefits of their investments without having to worry about high fees and charges.

Benefits of Investing in a Diversified Mutual Fund

Mutual funds offer investors several key advantages, such as diversification, cost savings, and professional management. A diversified mutual fund is a portfolio of multiple assets, such as stocks, bonds, and other securities. Diversifying your investments is one of the most important aspects of any smart long-term investment strategy. Here are some key benefits of investing in a diversified mutual fund.

1. Lower Risk: By investing in a diverse range of investments, your risk exposure is spread out across multiple markets. This means that any single market downturn or negative event won’t cause your entire investment portfolio to suffer. Diversification also helps protect against sudden changes in market trends or unexpected shifts in the economy.

2. Cost Savings: Mutual funds often provide investors with lower costs and expenses than creating a portfolio of individual stocks and bonds. Most mutual funds require only a minimum initial investment, which helps to reduce the overall cost of the portfolio. Additionally, most fund management services often reward investors with lower fees as they grow their investments.

3. Professional Management: Investing in a diversified mutual fund means that you’ll have access to a team of professional managers who oversees the performance of the fund. They can make sure that the portfolio is properly diversified and that investments are made in line with the fund’s objectives. This adds another layer of assurance to your investment.

4. Access to Specialized Investment Opportunities: Investing in a diversified mutual fund can also provide access to specialized investment opportunities that may not be available to individual investors. For example, a mutual fund may have the ability to invest in exotic markets or alternative investments. These types of investments can provide investors with growth opportunities not available through other investments.

Investing in a diversified mutual fund can provide several key benefits, including lower risk, cost savings, professional management, and access to specialized investment opportunities. Investing in a diversified portfolio helps to ensure that your investments are properly diversified and that you’re taking advantage of all of the potential opportunities available in the market.

Factors to Consider when Constructing Diversified Mutual Funds

Diversifying a mutual fund portfolio can bring a variety of advantages such as mitigating risk, generating a higher return on investment, and reducing costs. When constructing a diversified mutual fund portfolio, it is essential to consider a range of different factors.

Investors should first assess their own needs, consider their risk tolerance, and identify their long-term financial goals before selecting mutual fund investments. Having a clear understanding of an individual’s goals and objectives is key when making decisions about which mutual funds to purchase.

Another important factor to consider is the fund’s fees and expenses. Before selecting a fund to invest in, it is important to consider the fees and costs associated with the fund. Investors should also evaluate the track record of the fund and the organization behind it. It is important to understand the performance of the fund in different market conditions, and to compare the fund’s performance to other similar investments.

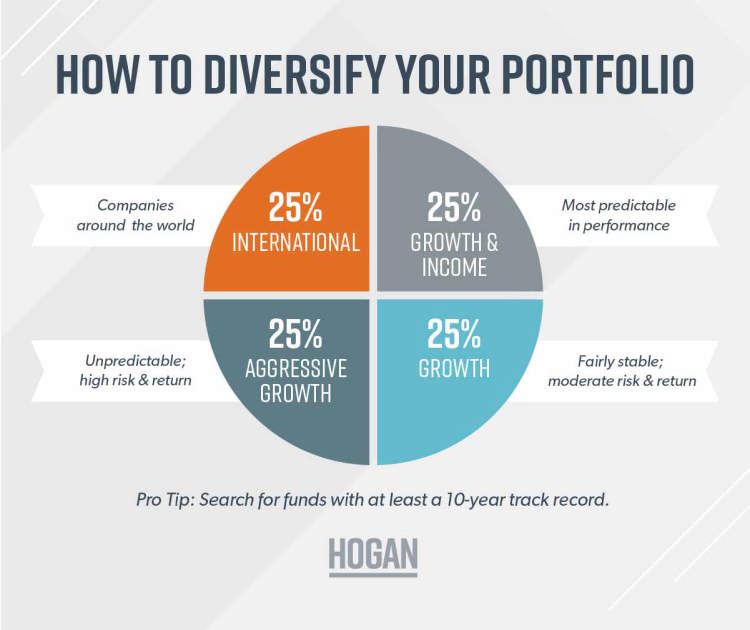

In addition to costs and performance, investors should consider the fund’s diversification strategy. While diversification can help reduce risk, there are many different ways to achieve this. Investors should take into account the geographic and asset class diversification the fund offers. It is also important to look at the sector diversification of the fund and understand both the domestic and international holdings in the portfolio.

Finally, investors should evaluate the fund’s liquidity. Mutual funds that are highly illiquid can be difficult to exit in case of an emergency and can often generate higher transaction costs. Before selecting mutual funds for a portfolio, investors should understand how liquid their fund is.

In conclusion, there are many key factors to consider when constructing a diversified mutual fund portfolio. It is important to understand one’s own objectives and risk tolerance, and to evaluate the fees, performance, diversification strategy, and liquidity of a fund before investing. By considering these factors, investors can make informed decisions and create a mutual fund portfolio that suits their needs.

Conclusion

Investing in diversified mutual fund portfolios can be a great strategy for optimising return and mitigating risk. Such portfolios can benefit investors by helping to maximise a portfolio’s potential for gains, while at the same time minimising its downside potential. This approach can also help to spread risk over a wide range of investments, which can have a significant impact on the investor’s potential returns.

When selecting a diversified mutual fund portfolio, it is important to consider the complexity of the strategies employed by the fund manager, the fees associated with the portfolio, and the overall outlook for the markets in which the funds are invested. In addition, investors should keep in mind the key advantages of diversified mutual fund portfolios, including the potential for gains, reduced volatility, and superior diversification. By following these steps, investors can enjoy the benefits of a successful diversified portfolio.