Asset allocation is a key principle for a successful and profitable investment journey. It is the process of assigning a particular percentage of the total portfolio to different asset classes for achieving a desired level of risk and return. This allows an investor to make the most of market opportunities while keeping their investment portfolio form becoming overexposed to costly and risky investments.

In addition to its ability to optimize returns, asset allocation also helps manage risk. By exposing a portfolio to multiple asset classes with different correlations, asset allocation techniques help diversify the risk across asset classes and reduce the odds of a major hit to the portfolio from a single event. Asset allocation also provides a way to build awareness of various asset classes and their underlying properties.

Understanding Asset Allocation Principles

Asset allocation is the process of strategically diversifying a portfolio by assigning a specific percentage of various asset classes, such as stocks, bonds, cash, commodities, real estate, and other investments. It is a key factor in managing an investment portfolio and can have a significant impact on your return. Understanding the principles of asset allocation can help you create an effective and balanced investment strategy.

Asset allocation can be divided into three broad categories: defensive, moderate, and aggressive. Defensive strategies prioritize lower risk investments such as cash and bonds. Moderate strategies introduce some stocks to increase potential return but maintain a focus on safety. Aggressive strategies are designed to maximize returns by investing heavily in stocks and other higher risk investments.

When planning an asset allocation strategy, it is important to consider both your risk tolerance and your long-term financial goals. If you have a low risk tolerance, you may prefer to invest primarily in defensive assets such as cash and bonds. If you have a higher risk tolerance, you may choose to invest more in medium- and high-risk assets such as stocks and commodities. Keeping in mind your financial goals in the long-term is also essential; for example, you may choose a more aggressive strategy if you are looking to maximize your returns over a short period of time, or a more conservative strategy if you are investing for retirement.

General Principles of Asset Allocation

- Diversify: Diversification is key to managing your portfolio. Investing across multiple asset classes helps spread your risk, which can lead to higher returns in the long-term.

- Balance: Balancing your asset classes is essential. Make sure that your portfolio contains a mix of both high- and low-risk investments to help protect against losses.

- Rebalance: Rebalancing your portfolio periodically ensures that your investments are in line with your goals and risk tolerance. Rebalancing also helps maintain a balance between growth and income.

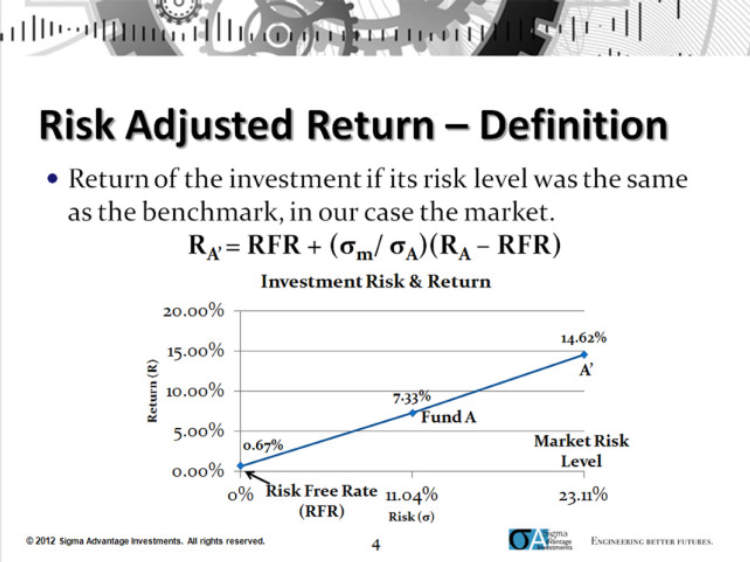

Maximizing Risk-Adjusted Returns through Proper Asset Allocation

Asset allocation is one of the cornerstone principles of investing, necessary for achieving a balanced and profitable investment journey. It comes down to understanding the risk and return of various asset classes, then allocating or diversifying investments to capture the potential reward with an acceptable level of risk. The goal is to maximize risk-adjusted returns while still reducing the amount of volatility in your portfolio.

When it comes to asset allocation, it’s important to understand your tolerance for risk ― the amount of losses you are willing to accept ― and also determine your objectives for the future. Then it comes to choosing the right mix of asset classes to reach your goals. Here are some important guidelines for proper asset allocation.

1. Understand Asset Classes

The first step of proper asset allocation is to understand the asset classes available. Asset classes typically include equities, bonds and cash, as well as other investments such as commodities, foreign investments and property. The performance of all these asset classes varies over time, so it’s important to understand how they tend to react to changing economic conditions.

2. Consider Your Risk Tolerance

Once you have a good understanding of the different asset classes, it’s time to consider your tolerance for risk. Generally, an investor with a higher risk tolerance will tend to allocate more of their portfolio to equities while an investor with a lower risk tolerance may prefer to allocate more of their portfolio to bonds.

3. Allocate Assets by Timeframe

It’s also important to consider the timeframe of your investments when it comes to asset allocation. Assets meant for short-term goals should typically be allocated to lower risk investments as they are less likely to suffer significant losses. Assets meant for long-term goals, on the other hand, can be allocated to higher risk investments due to the greater potential for returns.

4. Rebalance your Asset Allocation

It’s also important to periodically review and rebalance your asset allocation. This is important to ensure your investments are aligned with your long-term goals and risk tolerance. For example, if the price of equities rises, it’s important to rebalance the asset allocation to ensure that your risk tolerance and long-term goals are still met.

5. Diversify Your Investments

Diversifying your investments also plays an important role in proper asset allocation. This means allocating investments across multiple asset classes and markets, as well as across different sectors and countries. Diversifying your investments aids in reducing risk by spreading youriinvestments across multiple asset classes, sectors and markets, whilst still generating returns.

Building an Investment Portfolio Supported by Asset Allocation Principles

Asset allocation is a process of diversifying a portfolio by balancing different asset classes in order to achieve the desired returns. It helps in building a strong investment portfolio that is well balanced in terms of risk and return. Asset allocation involves optimizing the risk-return trade-off for a particular portfolio and also helps to manage the volatility of the portfolio. There are various asset allocation principles such as diversification, rebalancing, strategic asset allocation, tactical asset allocation, risk-adjusted return, etc. which investors should consider while building an investment portfolio.

When building an investment portfolio supported by asset allocation principles, there are a number of steps that need to be taken into account:

- Determine the investment goals: The investor must have a clear idea about his/her investment goals and purpose of investing to select the appropriate asset classes.

- Analyze the available asset classes: The investor should analyze each asset class according to its risk-reward prospects, return prospective, liquidity, etc.to decide which asset classes should form the base of the portfolio.

- Select the appropriate asset classes:Once the asset classes are identified, the investor should develop a portfolio that is well diversified and balanced.

- Determine the risk profile: The investor should assess the risk level of the portfolio to ensure that it is in sync with his/her appetite for risk.

- Rebalance the portfolio: Periodically, the investor should assess the performance of each asset class and adjust the asset allocation in order to maintain the desired risk-reward balance.

Adopting asset allocation principles in building an investment portfolio is an efficient way of managing risk and achieving returns. If used in a smart way, asset allocation can help to reduce risk and generate better returns. It is essential for investors to understand these principles and implement them diligently in order to stay on the path of meeting their investment goals.

Conclusion

Overall, a successful and profitable adventure in investing starts with understanding your goals and how much risk you are willing to take. Asset allocation plays a key role in helping investors reach their financial goals.Carefully thought out asset allocation decisions, combined with an understanding of how the markets work, will lead investors to a balanced and profitable investment journey.

The process of asset allocation is a task that no investor should take lightly. It requires an understanding of the market and what opportunities are available for the investor to make smart decisions. With careful consideration and understanding, investors can create a tailored asset allocation plan that is suitable for their individual goals and financial situation.