Many households confront overwhelming debt and financial crisis, and managing all of these debts can be an extremely stressful and daunting experience. One of the most effective strategies for dealing with debt is Debt Consolidation, which can reduce your total monthly payments and help you to get back to a healthier financial position.

In this article, we will explore what is debt consolidation and how it can contribute to your financial recovery, so that you can give yourself the best chance of navigating the process successfully and escaping from debt.

Understanding How Debt Consolidation Works

Debt consolidation is the process of taking out a single loan to pay off smaller loans or balances due with other creditors. The idea behind this process is to help make debt repayment more organized and manageable. It combines all of a consumer’s debts into one larger loan with one more achievable repayment plan. In many cases, this can help make it easier to manage one’s monthly finances — as well as lowering the amount of interest a consumer pays in the long run.

The concept of debt consolidation lends itself to two primary types — debt consolidation loans and balance transfer credit cards. A debt consolidation loan works by a consumer obtaining one large loan in order to pay off multiple debts. To help make repayment more affordable, the debt consolidation loan tends to have a lower interest rate than the original debt. Balance transfer credit cards also work in a similar way, but instead of taking out a loan, the consumer would be transferring the existing balances from other card accounts to one with a lower interest rate.

If you’d like to learn more about how debt consolidation works, here are the primary elements you should be aware of:

- Debt consolidation loans and balance transfer credit cards are the two main types of debt consolidation.

- These consolidation methods can make debt repayment simpler and more organized.

- A debt consolidation loan combines multiple debts into a single loan with a lower interest rate.

- Balance transfers from other card accounts can help you get a lower interest rate.

- Debt consolidation can make debt repayment more affordable.

Debt consolidation can be a great tool to regain control of your finances and make debt repayment more manageable. By understanding how it works and whether or not it’s the right choice for you, you can take an active part in the process of debt consolidation and financial recovery.

Advantages and Disadvantages of Debt Consolidation

Debt consolidation is a financial strategy that involves rolling multiple debts into one single debt. The most common methods for debt consolidation are personal loans and balance transfer credit cards with a 0% APR period. While debt consolidation can be a great way to simplify your finances, there are both advantages and disadvantages. Below, we’ll discuss the advantages and disadvantages of debt consolidation.

Advantages of Debt Consolidation

- Consolidating debts simplifies your financial life, as you only need to make a single payment per month.

- You may gain access to lower interest rates and longer payment terms, resulting in a more affordable monthly payment.

- Debt consolidation can allow for the faster repayment of your debt, improving your credit standing.

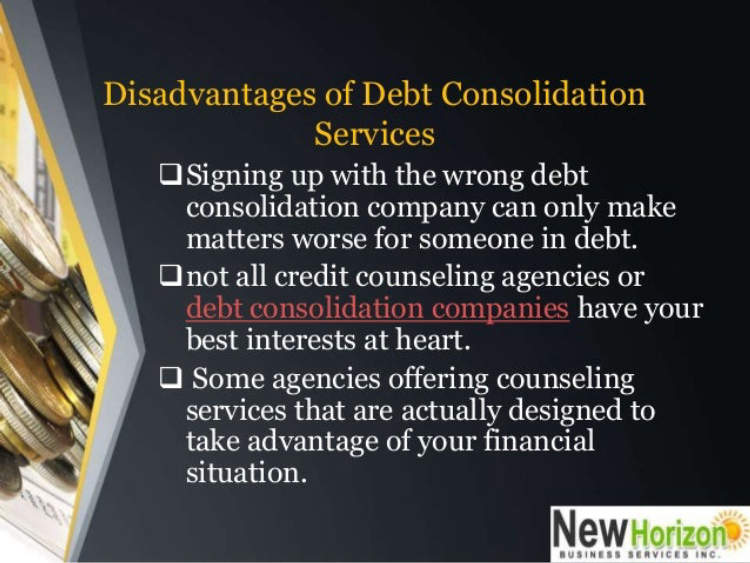

Disadvantages of Debt Consolidation

- There may be costs associated with debt consolidation, such as fees or an origination fee.

- You may consolidate some of your debt, only to accumulate new debt in the process.

- If you consolidate your debt with an unsecured loan, you’ll have to arrange personal collateral.

- Using a balance transfer card will involve paying a balance transfer fee.

Exploring Financial Recovery Options

Debt consolidation and financial recovery are two of the most effective options for getting out of mounting debt and regaining financial stability. Both involve reorganizing debt payment into one single payment; however, the approach is different. Debt consolidation involves grouping your liabilities into one loan to make repayment more manageable, while financial recovery focuses on improving your credit score by obtaining more favorable loan terms.

Establishing a plan for financial recovery and debt consolidation can be difficult for many people, especially those who have never tried it before. To make the best of this opportunity, it is important to explore all of your options carefully and be aware of any potential risks. There are five main approaches for financial recovery and debt consolidation:

- Debt Consolidation Loan: A single loan used to combine all of your liabilities into one payment can be a powerful tool in getting out of debt, as you may get a lower interest rate than other loans. The disadvantage is that you may have to submit to a credit check, which can cause a short-term decrease in your credit score.

- Consolidation of Credit Card Debt: This is an efficient way to get out of credit card debt by transferring the balance from your existing cards to one single card. This usually results in lower interest rates, which make it easier to pay off the card faster.

- Debt Negotiation: This is a more aggressive approach involving negotiation with creditors to reduce the amount of debt owed. It can be a good option if the borrower is unable to obtain a loan or qualify for other options. However, it is important to note that you may need to pay taxes on the amount saved through debt negotiations.

- Debt Management Plan: This is a viable option for borrowers with higher debt levels that need help in managing multiple loans, as it helps to consolidate payments into one monthly amount. It also can help improve credit ratings as long as payments are made on time.

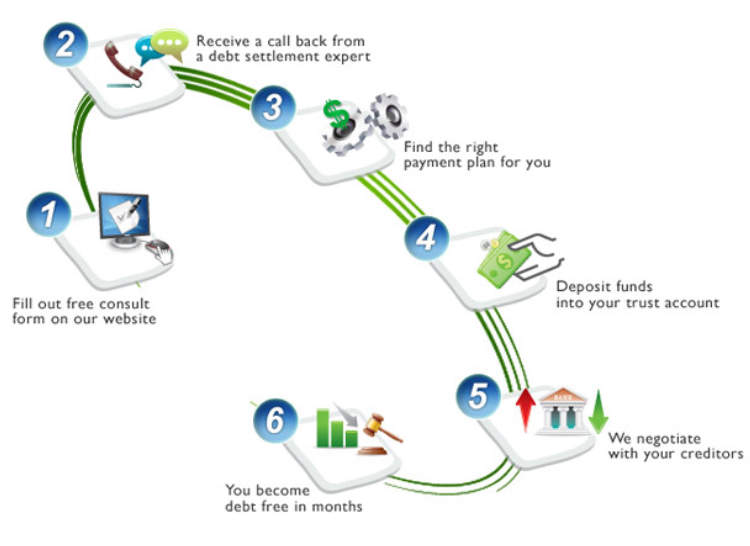

- Debt Settlement: This involves making a lump sum payment to creditors that is lower than what was originally owed. It can be very helpful in reducing debt levels quickly if you have the funds available and creditors are willing to accept the offer. It is important to note that debt settlements can have long-term effects on your credit score.

Exploring all of the available options for financial recovery and debt consolidation is key to finding an effective strategy that works for you. While it may take some time and effort to research the best approach, it will be well worth it in the end to regain financial stability.

Conclusion

Debt consolidation and financial recovery is a process that can seem overwhelming but is actually relatively straightforward. Understanding the different steps involved in the process, such as obtaining a credit report, consulting with a financial advisor, and budgeting, will give you the tools to make solid decisions and move forward with increasing financial stability. Being mindful of potential fraudulent activities, such as predatory lending practices, can also help safeguard your finances and protect your financial well-being.

Reaching financial stability is possible with knowledge, planning, and understanding each step of the process. With the help of a financial advisor, you can better assess your current debt levels and figure out a realistic repayment plan. Creating a budget and watching for fraudulent activity are just two of the ways you can get started on the journey to financial recovery and debt consolidation.