Having a healthy money mindset is an essential part of building a secure and prosperous financial future. By creating a framework that promotes and encourages financial stability, you’ll ensure that you make decisions that put you on the right path to achieving your goals.

That said, gaining the right money mindset can be a difficult challenge due to our society’s conflicting messages. Our goal in this guide is to equip you with the tools and strategies needed to form a strong financial foundation. We’ll explore 7 steps to take to shape a healthy money mindset for a prosperous financial journey.

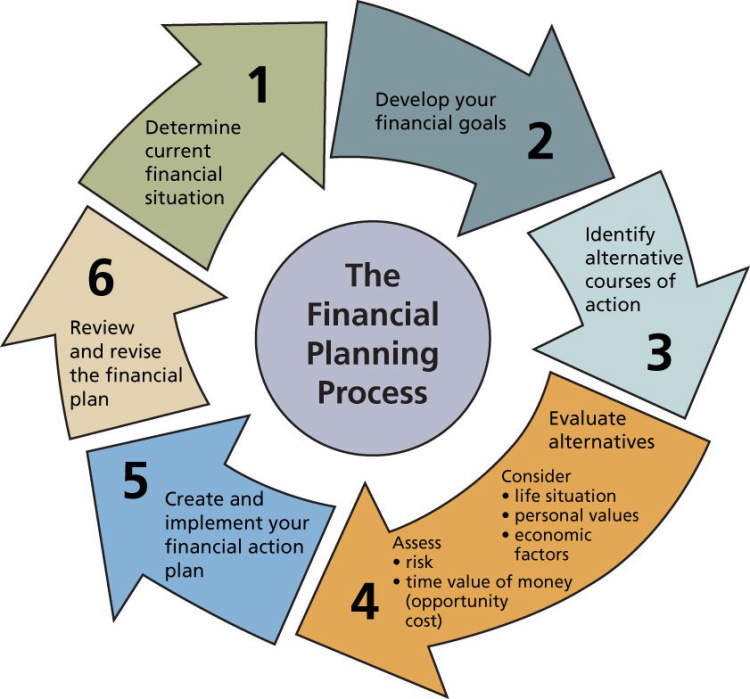

Step 1: Set Realistic Financial Goals

Taking control of your financial future starts by setting realistic financial goals. Defining your goals will provide clarity and motivation for building a healthier money mindset. A goal can be anything from paying off debt, increasing your savings, or finally taking the plunge and investing. Remember to make your goals realistic, achievable, and to set yourself a timeline for completing them.

Consider the following when creating your financial goals:

- Decide what your financial goals are.

- Identify when you want to achieve these goals.

- Break down the goals into smaller steps so you can track your progress.

- Prioritize what goals are most important to you.

- Choose measurable goals rather than vague desired outcomes.

Once you’ve set your goals, it’s time for you to get to work. Setting a plan to gradually reach your goals can be challenging, but it’s extremely rewarding when you start to see progress.

Step 2: Understand Your Current Financial Situation

The second step in creating a healthy money mindset for a prosperous financial journey is to understand your current financial situation. It’s important to assess and understand your net worth, income, debts, expenses, investments, and other financial aspects in order to identify potential areas for growth and improvement. Here are some tips to help you gain a better understanding of your current financial state:

1. Make a list of all your assets and liabilities.

Your assets include items you own that are valuable such as a car, house, savings account, investments, and other items you own that are worth something. Your liabilities include anything you owe money on such as a car loan, a mortgage, credit cards, or student loans. Knowing what you have and owe will help you determine your net worth, which is the difference between the two.

2. Calculate your net worth.

Your net worth is an important metric that will help you understand your current financial situation. It’s calculated by subtracting your total liabilities from your total assets. Knowing your net worth can give you a snapshot of your financial health and allow you to identify areas for improvement.

3. Track your bills and expenses.

Knowing how much you’re spending is essential to understanding your financial situation. Create a budget and track your bills and expenses to get an accurate picture of your spending habits. This will help you identify areas where you can cut back and save money.

4. Stay on top of debt payments.

It’s important to stay on top of any debt payments you may have to ensure you don’t fall behind and incur more fees or penalties. Pay off your debt as quickly as possible and use advanced debt repayment strategies such as the snowball method and debt avalanche method to reduce interest payments and pay off your debt faster.

Step 3: Create a Budget & Track Your Spending

Creating a budget is essential for having a healthy money mindset. It doesn’t matter if you have much to start with or not, building a budget and tracking your spending will help you achieve your financial goals. The key is to be as accurate and realistic as possible when constructing your budget.

To prepare your budget, it’s important to monitor your spending to get an understanding of where you money goes. This will help you decide which expenses you should allocate for (or cut out), and also what you have left for savings purposes.

There are two categories to consider when building your budget:

- Income: define your total income, coming from sources such as salary, dividends from investments, or retirement.

- Expenses: consider each of your monthly expenses, which may include: rent/mortgage, groceries, car payments, insurance, etc.

The next step is to determine how much you are able to save on a monthly basis. Consider setting up a separate account for your financial goals and allocate a certain percentage of your income to this account.

Once you’ve created your budget, track your spending and make sure you are staying within your targets. This will help you reach your goals in a timely manner, providing you with the joys of financial freedom.

Step 4: Prepare for Financial Emergencies

Financial emergencies can cause a lot of stress, so it is important to plan for them in advance. Preparing for financial emergencies can help you to gain financial security and stability during unexpected events. Here are a few tips to help you get started on building your plan:

- Create an emergency fund: Having an emergency fund gives you a cushion when facing an unexpected financial burden. Setting aside a certain amount of money to cover unexpected costs can help you avoid getting into deep financial difficulty.

- Curtail unnecessary expenses: Although it may seem difficult, it’s important to cut back on unnecessary expenses. This may mean no more extravagant meals out; instead, you should focus on preparing healthy, low-cost meals at home.

- Make sure you are insured: Having the right insurance for your needs is essential to protecting yourself against large financial burdens. Make sure you are covered for more than just the basics. Consider additional insurance for things such as medical costs, vehicle repair, or home repairs.

- Maintain a good credit rating: Keeping your credit rating in good shape is also important in dealing with financial emergencies. It is important to be aware of how much you owe, and to ensure all payments are made on time. This will help to ensure you have access to credit should you need it in a financial emergency.

By following these steps, you can be prepared for almost any situation. Financial emergencies can be daunting, but with the right preparation, you can ensure that you are prepared for whatever comes your way.

Step 5: Research Appropriate Financial Products

It’s important to research financial products carefully when it comes to forming a healthy money mindset. Investing in the right products can lead to a more secure and profitable future, while investing in the wrong ones can lead to financial ruin. It is therefore imperative that you take the time to research the financial products available and find ones that suit your objectives.

When doing your research, there are a few things to keep in mind. First, determine the level of risk you’re willing to take with your investments. This will help narrow down the types of financial products you should pursue. Next, ensure that the product fits into your financial strategy. You should also investigate the financial product’s fees, such as any management fees, commissions, and other charges. Finally, it’s important to compare the investment products side-by-side to determine which one provides the best overall value.

Some of the most common financial products include stocks, bonds, mutual funds, real estate investments, and exchange-traded funds (ETFs). Each of these has different risks and rewards, so it is important to understand how they work and decide if they fit into your financial goals. Take the time to thoroughly understand each one before deciding which product is best for you.

By researching the financial products available, you can ensure you make the best decisions when it comes to your money. Researching financial products will not only help you make more informed decisions, but it will also help you build a healthy financial mindset and secure a prosperous financial future.

Step 6: Automate Saving & Investing

Once you’ve developed a Financial Plan for your future, it’s time to automate the process of saving and investing for your future. The great thing about automating the saving and investing process is that it allows you to invest money gradually over time, without having to make any decisions about how much to save and where to invest. Automating the process also helps you to ensure that your money is always being used in the best way possible.

Here are some tips to get you started on your automated savings & investing journey:

- Set up direct deposit to your investment account so that a portion of your paycheck automatically invests each month.

- Automate your savings by setting up an automatic transfer from your checking account to a savings account each month.

- Set up automatic rebalancing, so that your investments are automatically adjusted based on market conditions.

- Set up automatic dividend reinvestment, so that dividends are automatically reinvested into your investments.

Following these steps will help you establish a healthy money mindset for a prosperous financial journey. Automating your savings and investments will ensure that your money is always invested in the best way possible, and will make managing your investments easier and more cost-effective.

Step 7: Monitor Your Financial Progress & Make Necessary Changes

No matter how smart or well you plan your financial strategies, you still require to monitor them consistently and make necessary changes as situations may change and brings about new opportunities. To gain a healthy financial mindset, you need to stay accountable with a plan that some may call ‘financial goal keeping’.

Here are a few practical tips that can help you stay on top of your financial progress and make necessary changes:

- Keep track of your financial habits and make sure to review your financial goals at least every quarter.

- Record your income and expenses and take stock of any surprises on a regular basis.

- Pay off debt as quickly as you can to save on interest payments.

- Set realistic expectations instead of focusing on absolute numbers.

- Be open to adjusting or developing new strategies if needed.

- Create a financial awareness habit like reviewing your financial statements quarterly.

Keeping track of your finances doesn’t have to be a tedious job. Use online financial management tools to make your financial tracking easier. You can even go for financial coaching for a more personal touch. The goal of regularly monitoring your financial progress is to help you review and make any changes and adjustments quickly, as soon as your financial circumstances change.

Conclusion

Building a healthy money mindset is an important part of any successful financial journey. It takes some study, practice, and self-discipline, but with the process laid out in 7 steps, it can help to build a strong financial foundation. Cultivating an independent and conscious approach to wealth can lead to confidence in money decisions, and greater control over financial security.

Formal financial education can help build good habits and provide knowledge in areas such as budgeting, investing, and debt management. As a result, it will also serve as a guideline to make sound financial decisions. Stay focused on the long-term financial goals, and use these 7 steps to shape a healthy money mindset and achieve financial prosperity.