Compound interest is a powerful financial tool that can be used to exponentially increase wealth accumulation over time. However, in order to utilize the full potential of compound interest, it is essential to have a complete understanding of how it works.

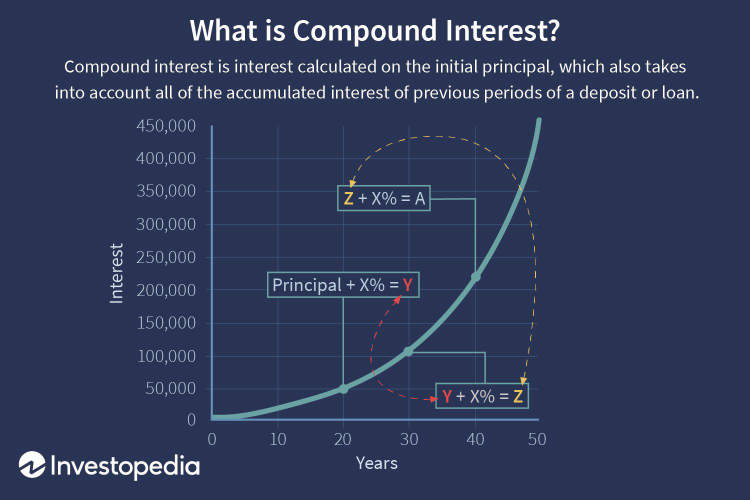

Compound interest works by accumulating interests earned to the initial principal. This process means that the interest rate is applied to both the initial principal and accumulating interest. Through this process, the accrued wealth will grow faster as the amount of principal invested is larger.

Understanding the Basic Theory Behind Compound Interest

Compound interest is one of the most powerful tools available to financial advisors and investors alike, and its understanding is essential to understand the power of exponential wealth accumulation. Compound interest is the interest earned on both the principal of an investment, as well as on any interest that has been reinvested or earned in the past. Over time, the interest grows exponentially, creating additional wealth for the investor.

The three fundamental variables associated with compound interest are:

- Principal – This is the initial sum of money invested or borrowed.

- Interest Rate – This is the annual rate of interest that is earned or paid.

- Time – This is the timeframe over which the interest is calculated.

The calculation of compound interest can vary based on the frequency in which compounding is applied. Compounding can be applied annually, semi-annually, quarterly, monthly, weekly or daily. Generally, the more frequent the compounding, the higher the amount of interest earned.

In addition, different investments can compound at different rates. When choosing an investment vehicle, it is important to explore the different compounded interest rates available to maximize gains. The duration of the investment can also play a role in compound interest and should also be considered when making an investment decision.

Once all of the variables are determined, compound interest can be easily calculated with a simple formula:

- CI = P (1 + r/n)nt

Where:

- CI = Compound Interest

- P = Principal Amount

- r = Interest Rate per period

- n = Number of compounding Periods per year

- t = Number of Years of Investment

In conclusion, understanding the basics of compound interest is the first step to understanding the power of exponential wealth accumulation. When properly applied, the effects of compound interest can be incredibly helpful in achieving financial freedom, wealth creation, and futures.

Exploring How Compound Interest Generates Exponential Wealth Growth

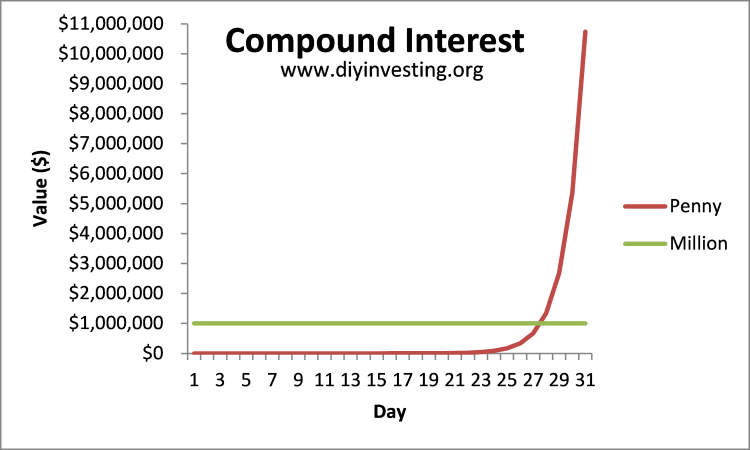

Compound interest is a powerful tool in building and accruing wealth long-term. Whereas simple interest only earns on the initial investment, compound interest earns on the initial investment and subsequent returns. This allows the investment to rapidly grow over time, making compound interest invaluable for those wishing to accumulate wealth.

The power of compound interest lies in how it accrues interest over time. While simple interest may make a small amount of money, compound interest will allow investors to watch their savings grow significantly over time. This occurs, because the interest earned over the course of the investment is reinvested and can then begin to earn interest too. This allows investments to grow exponentially due to the continuous cycle of interest earning on interest earnings.

Below are three major benefits of compound interest in accumulating wealth:

- Compound Interest Generates Wealth Over Time – By reinvesting interest earnings, compound interest will allow investments to accumulate wealth exponentially, instead of slowly through linear growth.

- Compound Interest Reduces Risk – because the original investment isn’t just sitting there, it’s constantly generating returns and growing. This means that overall, there is far less risk associated with compound interest than with a simple interest investment.

- Compound Interest is Affordable – Because compound interest works through reinvesting returns rather than making more upfront investments, compound interest can be extremely affordable for those with even small investments.

Compound interest is one of the most effective tools in building and accruing wealth. Its power lies in its ability to generate wealth over time through continuous reinvestment of returns while minimizing risk along the way. This makes it one of the most affordable and effective ways to accumulate wealth.

Harnessing Compound Interest to Maximize Your Wealth Accumulation

When it comes to making money, compound interest is the secret to success. Compound interest is a powerful tool that can be used to maximize wealth accumulation over time. Essentially, by reinvesting earnings into the same account, compound interest allows you to realize growth much faster than traditional savings and investment accounts.

To illustrate the power of compound interest, let’s say you make an initial investment of $100 and are able to accrue interest of 10% per year. According to the rule of 72, if you reinvest the earnings into the same account, after seven years the initial $100 will become $200. That’s simply the power of compounding.

Fortunately, harnessing compound interest to maximize your wealth does not require a large initial investment. In fact, compounding can be utilized regardless of the size of your initial investment or how much periodic deposits you are able to make. Here are a few tips for taking advantage of compounding to grow your wealth:

- Start early – The earlier you start to save and invest, the greater the effect of compounding on your wealth.

- Choose the right accounts – When selecting accounts, look for those that offer the highest interest rates. With compound interest, the higher the interest rate, the better.

- Be consistent – It’s important to consistently contribute to your account. Regular deposits will ensure that you maximize compounding.

By utilizing the power of compound interest, you can get the most out of your savings and investments. With a disciplined approach to saving and investing, you can achieve your financial goals much faster – and reap the rewards of compounding.

Conclusion

The power of compounding interest in terms of exponential wealth accumulation can be a powerful tool for achieving financial success. Understanding how compounding interest works and how it can be applied to wealth building can help you maximize your savings and achieve wealth goals faster. With careful planning, the right investment vehicle, and a good understanding of compounding interest, you can take full advantage of the power of compounding interest to achieve financial freedom.

Furthermore, it is important to include compound interest in your financial planning. By building the concept of compound interest into your investment strategy, you can increase the rate at which your wealth accumulates and even accelerate your path to financial success in the long run. Compounding interest has the potential to yield rewards that are far beyond what is achievable through plain saving alone.