In a world where insurance policies are increasingly complex, making decisions on one’s own can be confusing and often leads to catastrophic outcomes. In this article, we will be demystifying complex insurance policies and looking for strategies to make sound decisions in the face of intimidating complexities.

We will be supported with case studies and examples, helping us understand the various nuances of making decisions for our greatest advantage. Through this article, readers can become more informed and better equipped to take on the challenge of making sound decisions related to insurance policies.

What Are Complex Insurance Policies?

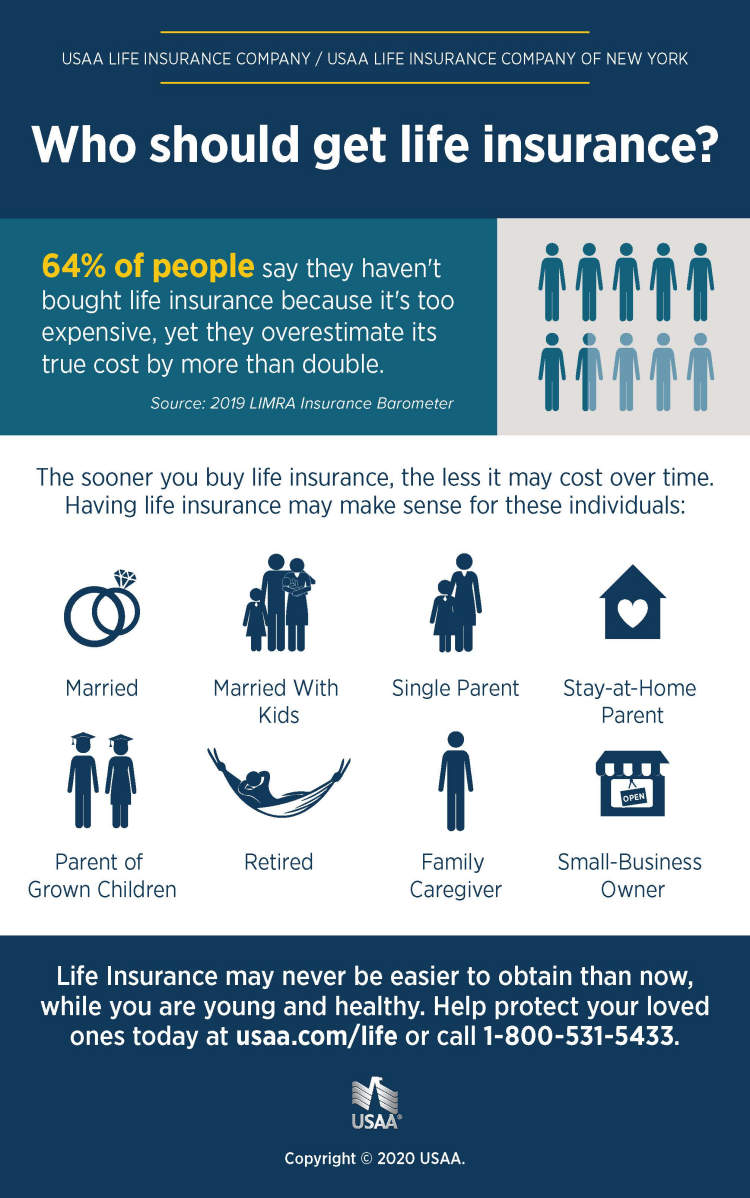

Complex insurance policies are specialized insurance policies that cover complex issues. They are often considered difficult to understand and are not common in many countries, but are becoming increasingly popular. Complex policies may cover various subjects such as business interruption insurance, cyber liability insurance, directors and officers insurance, and professional indemnity insurance. They provide financial protection that traditional insurance products can’t.

Complex insurance policies are tailored to the unique needs of the policyholder. They are used to cover risks that may be difficult to insure with a traditional insurance policy. They are usually designed by an experienced insurer who takes into account the specific risk factors of the policyholder. Some examples of complex insurance policies include:

- Non-standard auto insurance – Covers non-standard automobiles such as classic cars, high-end custom cars, and high-performance cars.

- Umbrella insurance – Covers personal liability for a large number of exposures.

- Business liability insurance – Covers liability for a business’ operations, including product liability and premises liability.

- Cyber liability insurance – Covers liability for data breaches, malware or ransomware attacks, and other cyber-related risks.

Complex insurance policies are usually more expensive than traditional policies but are generally worth the extra cost. They are designed to protect the policyholder from liability and financial losses, and they are typically more comprehensive than standard policies. It is important to understand the specific needs of the policyholder before deciding on the type of complex insurance policy to purchase.

Important Aspects to Consider When Choosing a Complex Insurance Policy

When it comes to insurance policies, selecting a complex scheme can be daunting. There are so many products available that it can be hard to determine which is the most suitable for your needs. As such, here are some critical aspects to consider when choosing a complex insurance policy.

Coverage Options

Having adequate coverage is crucial when selecting an insurance policy. There are often numerous coverage options available, so it is important to compare the different types and select one that covers all the essential elements. Most complex policies will provide specific coverage, so it is a good idea to take some time to review what is included in each one.

Rates & Fees

It’s always important to evaluate the cost of any insurance policy before making a purchase. The rates and fees will vary significantly depending on the type of policy you select, so be sure to compare the costs and select the one that provides the best value for your money. Additionally, many insurance companies will offer discounts if you purchase more than one policy, so be sure to look into these offers as well.

Claim Process

The claim process is an important element to consider when selecting a complex policy. Be sure to understand the requirements for filing a claim, including what documentation is necessary to submit. Additionally, ask questions about the length of time it would typically take for the insurance company to process the claim and for the payout to be disbursed.

Customer Service

It is also essential to consider the quality of customer service offered by the insurance company. Even if the coverage and rates are reasonable, it is still beneficial to work with someone who is responsive and provides excellent customer service. Additionally, if you have any questions or need further clarification about the policy, you will need to be able to talk to someone who is knowledgeable and can provide you with the answers you need.

Flexibility

Finally, when choosing a complex policy, it is important to look for one that offers some degree of flexibility. This is especially important if your needs may change in the future. Opt for a policy that includes the ability to adjust the coverage and terms in order to reflect your changing needs.

Key Steps for Making An Informed Decision on Complex Insurance

Making an informed decision on complex insurance can be daunting, especially if you are not familiar with the policies and products on offer. To help you make the right decision, here are the key steps for making an informed decision on complex insurance:

- Do Your Research: Research insurance policies, terms, and coverage options before making any decisions. Compare different insurance policies to get a better understanding of which ones are suitable for your lifestyle and budget.

- Ask Questions: Ask questions if you are unsure about any part of the policy. Find out the details, such as what type of coverage is provided and what exclusions apply.

- Consider Other Options: Shop around and compare different insurance providers to get the best coverage at the best price. Consider lower-cost options or alternative coverage.

- Read the Policy: Read the policy carefully to avoid surprises. Ask questions if you don’t understand any part of the contract.

- Understand the Risks: Consider the risks associated with your policy, such as changes to your circumstances or changes to the policy. Find out if you are able to cancel or change the policy should the need arise.

- Review Your Decision: Review your decision periodically to make sure it is still the best option for you.

Whenever making a decision involving complex insurance policies, it is important to take your time and ensure that you are making the right decision for your needs. By taking the above steps, you can make an informed decision that will provide you with the protection you need.

Conclusion

Making informed decisions about insurance policies can be intimidating, as these policies are often complex. Staying on top of regulatory changes and understanding which policies are suitable for specific situations is essential for anyone involved in the industry. By understanding the fundamentals of insurance policies, anyone can navigate their way through the complexities of the insurance market. In conclusion, while complex insurance policies may seem daunting, with a proper understanding of the principles and features of the policy, individuals can make sound decisions in selecting the right coverage for their needs.